Market Will Start To Hit Resistance Soon – Here Is A Stock I Would Like To Buy Cheaper [Pick]

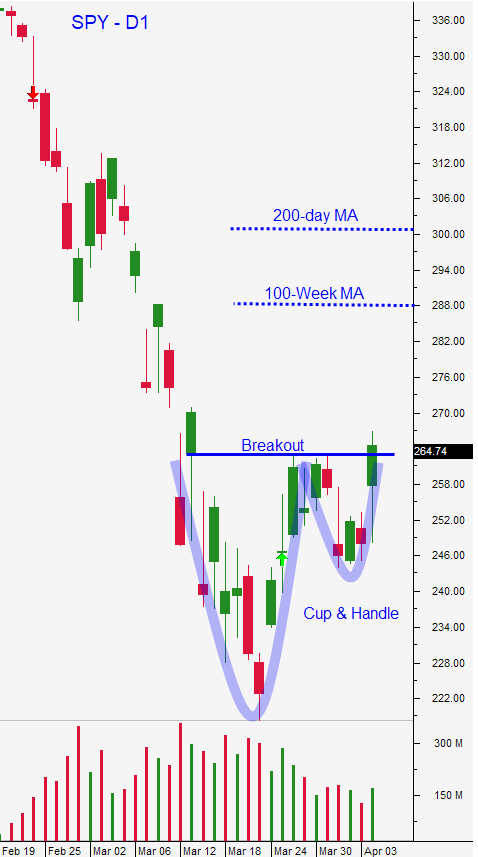

Posted 9:30 AM ET - Last week the market rallied more than 12% and that is its best week ever. According to healthcare experts, the Coronavirus seems to have hit its peak and fear should subside gradually. This market bounce was expected, but we don't know how quickly the economy will recover. I still believe that there is more upside as earnings season begins tomorrow and my first target is SPY $288.

The lockdown needs to end on April 30th and businesses need to restart operations immediately in May. Every additional week that this is delayed will make the economic recovery exponentially more difficult. If this lasts until Memorial Day there will be serious credit issues.

The government has already committed $4 trillion in stimulus and that will barely get us through the April 30th lockdown. There ISN’T another $4 trillion in the war chest to get us through the month of May if this lingers. Like every other country in the world, we are printing money like mad.

Our national debt was less than $2 trillion two decades ago and it took us more than 200 years to reach that level. Now we are blowing through that like it is chump change. The spending problem spans beyond our government. Credit extremes can be found throughout the entire spectrum (consumers, municipalities, states and corporations). It is a sorry state of affairs when the average household doesn't have enough saved to shoulder a month of hardship. We've had to throw the kitchen sink at the problem and we still don't know if all of the stimulus will work. We can blame this crisis on the Coronavirus, but sooner or later something would have threatened this house of cards.

Sovereigns are guaranteeing each other's currencies through swaps. They recognize that if one fails, they all fail. As long as they agree on how much money each of them can print, the game will continue.

Central banks around the world have pushed global interest rates below 0%. Now it will cost money for you to deposit funds in a bank. No one wants to invest in bonds because the yields don't even keep pace with inflation. This creates a natural bid for the market.

Banks will kick off earnings season tomorrow (J.P. Morgan Chase and Wells Fargo). Over the weekend Chase announced that they are tightening loan requirements for new mortgages. Buyers must put 20% down and they must have a credit rating greater than 700. This will impact the housing industry. Chase is concerned with declining property values and consumer credit. Earnings season will be critical to the extent that any guidance will be provided. Many companies are not providing guidance so there is little clarity.

OPEC announced a deal this weekend that will cut 9.7 million barrels of production per day. There isn't enough storage capacity and it's estimated that there is over 1 billion barrels of inventory. This glut needs to be worked off and gasoline prices could fall below one dollar per gallon. There will be credit issues in the capital-intensive oil industry (mainly on the production side).

Swing traders need to place a limit order to sell our SPY position at $288. That is my first target and I hope we hit it. We are selling out of the money naked puts on companies with strong balance sheets that will not be dramatically impacted by the Coronavirus. Stock selection is absolutely critical and you have to roll up your sleeves and look at the financials. Cash is king. We don't want companies that have a huge debt load and an immediate need for cash flow. Option implied volatilities are still very high and we want to take advantage of that. I believe that the current market bounce will last a couple of weeks. The next move will depend entirely on the lockdown and the speed with which companies can restart operations. At this juncture we have no clue of how this will play out. Last night I recorded a video and I have highlighted a stock that I think will tread water. They have plenty of cash for the next few months and want to sell out of the money puts. It can drop to the low of the year and we will still generate a 10% return in the next month.

.

.

.

CLICK HERE TO WATCH A SHORT VIDEO - BULLISH PUT SPREAD PICK

.

.

.

Day traders need to watch the early drop today. The bid will be checked and early weakness this morning will give us an opportunity to find relative strength. Once the market finds support we will buy these stocks and set passive targets. During the market bounce these stocks will move higher and we will take our profits. Then we will sit on the sidelines and wait for another window of opportunity. I still prefer trading from the long side, but this market bounce will provide some nice shorting opportunities now that we are "off the deck". Be very patient with your trades and wait for those market reversals to set up.

Resistance is at SPY $281 and $288. Support is at $274 and $266.

.

.

Daily Bulletin Continues...