Take Profits On SPY – Here Is Your Target – Resistance Will Start To Build In 2 Weeks

Posted 9:30 AM ET - Yesterday the S&P 500 gave back the gains from Tuesday and this is a reminder that the recovery process will be gradual. We can expect selling when the market gets ahead of itself. Buyers anticipated a deceleration in the spread of the Coronavirus and that explains the rally the last few weeks. Conditions are improving and many countries are preparing to go back to work. Economic activity has come to a screeching halt and now it’s time to roll up our sleeves and get back to work. The S&P 500 still has some upside, but resistance will start to build.

The spread of the Coronavirus has peaked and President Trump plans to remove the lockdown in some areas of the country. Similar actions are being taken around the globe. According to all of the models, this climax was predicted and the market rallied in anticipation of the news. The economic statistics will be dire for the next few weeks. Empire Manufacturing saw its largest loss ever and retail sales were down 8.7%. This morning we learned that housing starts were down 22.3% and that unemployment claims were up by 5.2 million. We should expect more dire news in coming weeks.

If the lockdown ends on April 30th and companies restart operations immediately in May, there's a good chance we can get back on track and contain credit issues. Every week that the lockdown lingers, the economic recovery becomes exponentially more difficult. The government has approved $6 trillion in stimulus and the war chest is almost empty. We aren't even back to business and there we don’t have another $2 trillion to throw at the problem. America needs to get back to work immediately to avoid credit issues.

Earnings season is underway and banks are dominating the headlines. The results have been poor and massive bad loan write-downs are being taken. Consumer credit issues are on the rise and lending practices are tightening. With interest rates at 0% it will be very challenging for banks to make money. Banks have been selling off after reporting earnings and this is a warning sign for the overall market. Mega cap tech stocks will start reporting next week and I believe most of them will be able to shoulder the blow. Netflix, Amazon, Facebook, Google and Microsoft could all benefit from the coronavirus. These companies are “cash rich” and they will weather the storm. Unfortunately, they are not representative of the rest of the S&P 500.

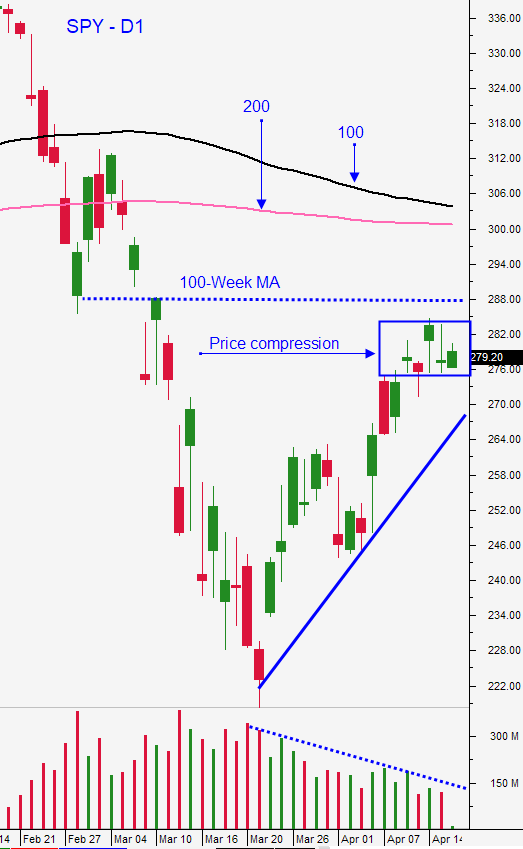

Swing traders should place an order to sell the SPY position at $288. I still believe that the market has some upside and that target is in reach. In the next few weeks the focus will shift from the virus to our economic recovery. This will be a long process and the market is likely to pull back as we hit a number of speed bumps along the way. We will continue to sell out of the money puts and out of the money bullish put spreads. We want to take advantage of high option implied volatilities and we want to generate income while the market finds its footing. As option implied volatilities contract, we will adjust our strategy. We need clarity and we won't have that for a few more months. I'm expecting a bottoming process that lasts most of the summer. Last night I posted my Weekly Swing Trading Video and it includes bullish put spreads and parish call spreads. I feel that there are opportunities on both sides of the market. The key is selecting the right stocks and Option Stalker searches help us do that.

Day traders should look for a flat open. We will wait for the market to establish a direction. Once the first move runs its course there should be a contra move that presents an opportunity. That move could be on the long side or the short side. We have been making the vast majority of our money in the morning session. If the first move this morning is lower, stocks with relative strength will be revealed and we will buy once support is established. This has been an incredibly successful strategy for us and Option Stalker helps us find the stocks. We wait for the OneOption market indicator (1OP) to trough and we buy stocks when it crosses. As the market bounces the stocks jump higher and our target profits are reached. The goal is to get back to a cash position and then we wait for the next opportunity. I am trading half of my morning size in the afternoon because the price movement is less predictable. I still prefer to trade from the long side given my bullish market bias for the next week or so. Make your money early and get into a cash position. Instead of babysitting problematic trades you will be objectively looking for new opportunities.

The market has been flat over the last six trading sessions and we are seeing price consolidation. That means that the daily ranges will be relatively compressed and we should see two-sided action and trading ranges. I don't believe we will see any bullish or bearish trend days until we get into the "meat" of earnings season next week.

Support is at SPY $276, $272 and $265. Resistance is at SPY $284 and $288.

.

.

Daily Bulletin Continues...