Market Still Has Upside – The Drop Today Is A Reminder That Resistance Is Building

Posted 9:30 AM ET - Yesterday the S&P 500 rallied 70 points higher and this morning those gains are going to be given back. News that the spread of the Coronavirus was decelerating attracted buyers after a three-day weekend. The first step to an economic recovery is the containment of the virus. Only then can we restart businesses and resume our normal lives. This will be a process that takes many months and we should not expect a "V” bottom recovery.

President Trump indicated that 29 states are in good shape in terms of the virus and that he could grant them permission to open their economies before the May 1st timeline. The death toll will be much lower-than-expected and each week that we stay in a lockdown the recovery becomes much more difficult. The government has already allocated $4 trillion worth of stimulus and we are only one month into the shutdown. There is not another $4 trillion to tap and there will be credit issues if this shutdown continues well into May.

Central banks are printing money like mad and they are guaranteeing each other's currencies through swaps. They know that if one fails, they all fail.

Yesterday the IMF said that global growth will decline by 3% in 2020. Domestic growth will be down 5.9% and growth in Europe will be down 7.5%. Growth in China is only expected to drop 1.2% in 2020. Tomorrow they will release key economic data (retail sales and industrial production).

Domestic economic releases will weigh on the market. This morning we learned that Empire Manufacturing fell to -78.3. Retail sales fell 8.7% and I think that is grossly underestimated. In the next few weeks we will start to get a clear picture of the economic impact and it won't be pretty. This will be a cold splash of water and market support will be tested.

Earnings season has started and banks will dominate the scene. J.P. Morgan Chase took a massive bad loan write-down and it missed estimates by a wide margin. Financials were weak across the board yesterday and that could signal upcoming credit concerns. J.P. Morgan Chase tightened mortgage lending practices last week. Homebuyers will need to put 20% down and they will need to have a credit rating of greater than 700. Tightening credit conditions during an economic decline is worrisome.

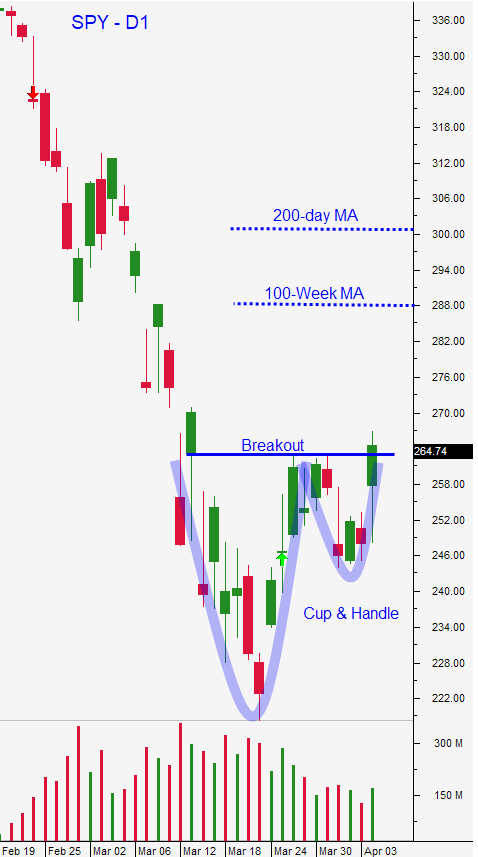

Swing traders should set a target of $288 for our SPY position. I feel that this leg of the rally is getting tired and we should be able to hit that first target in the next week of trading. We will wait for pullbacks like the one that we have this morning and we will look for put writing opportunities. We want to sell far out of the money naked puts with the intention of buying the stock at that strike price through assignment. If we are not assigned we will collect a 10% profit on average for one month worth of risk exposure. Option implied volatilities are declining and this strategy will gradually shift to bullish put spreads in the next month. If option implied volatilities drop enough we will consider call buying opportunities. It is still too early to tell how long this will take to play out and we need clarity. We don't know how quickly companies will be able to restart operations and we don't know if consumers will change their spending habits.

Day traders need to look for relative strength this morning as the market pulls back. Once support is established, trade from the long side. We are timing our entry based on our proprietary 1OP indicator. Off of deep troughs we wait for a bullish 1OP cross and then we start buying stocks with relative strength. We set targets and we sell into strength. Once we are in a cash position we wait for the next window of opportunity. We have been able to catch one good move early in the day. Sometimes there is an opportunity in the afternoon, but the quality of those trades is lower and we use smaller size.

I believe that there is still a little more upside to the market. Weak economic data points will weigh on the market and this bottoming process will last most of the summer. The speed of the business restart and consumer spending habits will determine market direction.

The longer this recovery takes, the greater the likelihood of a credit crisis.

Support is at SPY $265 and $272. Resistance is at SPY $285 and $288.

.

.

Daily Bulletin Continues...