Take SPY Profits This Morning – Good News Is Priced In and Road Ahead IS Bumpy

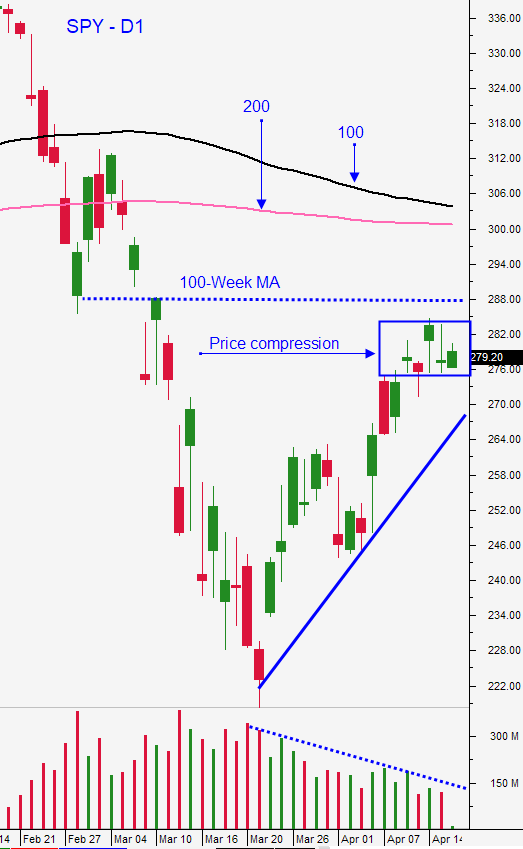

Posted 9:30 AM ET - This morning the S&P 500 is up 75 points and our first target will be reached at the 100-week moving average. President Trump plans to reopen the country in stages and he outlined his plan. There is a sense of urgency and credit conditions will deteriorate if the lockdown continues for more than a couple of weeks. Gilead Sciences reported excellent results on their drug and that is also boosting investor confidence. We are going to take profits on our SPY position this morning.

The overnight news was good and our country needs to get back to work as soon as possible. The loans for small businesses are already tapped out and Congress is trying to appropriate another $250 billion to the program. An estimated $6 trillion has been dedicated to the stimulus program and we haven't even emerged from the lockdown. There is no more money in the war chest and every week that this shutdown continues the likelihood of a credit crisis increases.

In general, the virus news is improving and that is already "priced in". Asset Managers were expecting the virus to climax globally. Unfortunately, it is very stubborn and new cases are emerging in areas where it was believed to have been contained (France and Italy). The Coronavirus is also starting to spread into other areas of the US. Wisconsin announced that it will be in a lockdown until May 26th.

Even if the lockdown ends immediately, we still don't know if businesses will restart operations instantly. This will be a gradual process and if business loans are delayed it will take even longer. Consumers will be very cautious until they know their job is secure. The government stimulus checks could be delayed by a few months if the worker doesn't have direct deposit bank information on record with the government.

Economic releases during the next couple of months will deteriorate and this news will weigh on the market. China posted its numbers last night and they were better than feared (if you trust what they report).

Earnings season will attract buyers, but I expect to see selling after mega cap tech earnings. Goldman Sachs said that they believe Apple's stock will drop by 20%. It is the most vulnerable out of the tech giants. Microsoft, Amazon and Netflix should do well, but Google and Facebook are likely to see advertising revenues decline. Banks have dominated the early scene and the financial sector has been weak after reporting earnings. Banks are tightening credit policies and bad loan write-downs are rising quickly.

Swing traders should sell the SPY position at $288. Place an order to sell at that price and if you're not filled within the first 30 minutes, place a market order. I want to take profits here. The market still has some upside and it could get to $300. I believe that best case scenarios are getting priced in and that the road ahead will be hard. We were heavily weighted on naked put positions that will expire today and we will largely be in cash again. We will have captured a 20% return on our SPY position and an average of 10% return on our naked put positions. We were in cash before the big drop and we've had an excellent year so far. It's time to go to the sidelines and to wait for clarity. As the market rallies I believe there will be some call selling opportunities (bearish call spreads). In this week's Weekly Swing Trading Video I highlighted four of them and we have a good chance to get filled today.

Day traders should watch the early action. If the market rallies to our first target and then reverses with a new low of the day, some of the gap will fill in. If the market is able to grind higher and hold most of the gains we will see compress most of the day. We need to tread cautiously and wait for direction. I believe there are opportunities on both sides of the market at this level. We will use the 1OP indicator as our guide.

We've made fantastic returns in the last two months during the biggest market decline since the Great Depression and we will take profits and wait patiently for clarity and market direction.

.

.

Daily Bulletin Continues...