Market Bid Will Start To Weaken After Mega Cap Tech Earnings

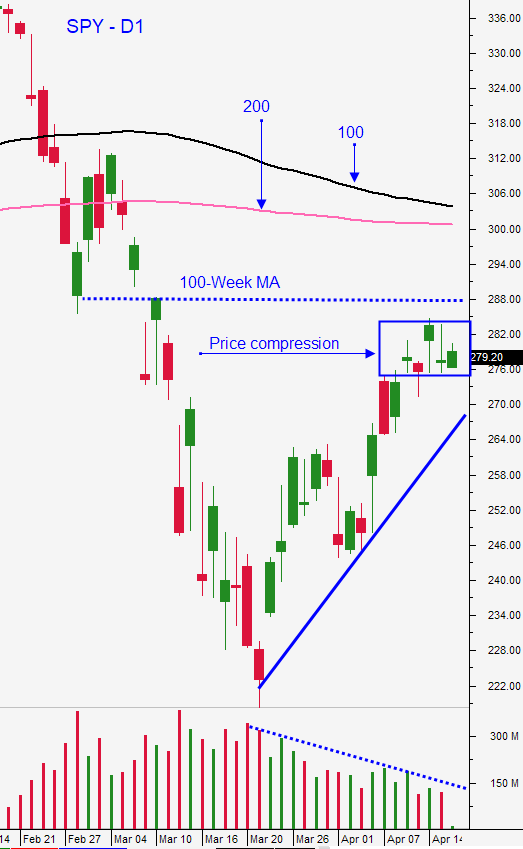

Posted 9:30 AM ET - Last week the S&P 500 rallied to my first target at the 100-week moving average and we took profits on our SPY position. A strong rally in the last 15 minutes of trading fueled much of the move and the S&P 500 is giving its late day gains back this morning. This will be a heavy week for earnings announcements and 20% of the S&P 500 will report. I still believe the market has a strong bid, but that it will weaken after mega tech stocks report.

The Coronavirus spread is decelerating, but the virus is very stubborn. Parts of the country are seeing an increase and in some states the lockdown has been extended well into May. Even one the shutdown is lifted, we don't know how anxious people will be to resume their normal lifestyles. Large crowds will be avoided for many months and consumers will curb spending until they know that their jobs are secure.

The government should pass another bill that adds $300 billion to the small business stimulus program this week. Those funds are running dry. The longer the shutdowns last, the longer it will take for the economy to recover. Each week that we stay in lockdown increases the chances for a credit crisis exponentially. The US needs to be back on track as quickly as possible.

The first leg of this rally was violent and Asset Managers bought from a deeply oversold condition in anticipation that the spread of the virus would decrease. The shutdown remains and it may not be lifted as quickly as expected. President Trump will leave this decision up to each state. This rally seems a bit overextended and good news is priced in.

I believe that containing the virus was the easy part. There are many drug trials and they look very promising. This threat will soon pass, but then the hard work will begin.

Our economy was in fantastic shape at the beginning of the year and it was "clear skies ahead". In an instant, a tornado ripped through the country and leveled most of it. We are counting casualties and the "sun" is shining again. Now we have to deal with the aftermath. This process will be very difficult and I believe that the market is discounting potential bankruptcies and credit issues. America is only one example of what's happening around the globe.

Swing traders took profits on our SPY position last Friday and that yielded approximately a 20% gain. Many of our naked puts expired last Friday and we are in a nice cash position. We have some naked put positions that will expire in the next few weeks and they are safely out of harm’s way. We will be looking for post earnings plays in the next few weeks while the dust settles. We need clarity and we need to see how quickly the recovery can begin. My goal is to stay liquid. If the market continues to shoot higher I will be looking for put buying opportunities.

Day traders need to wait for a clear sense of direction this morning. Relative strength will be easy to spot on this market pullback and I am most likely to trade from the long side once support is established. We will set passive targets and take profits on the market bounce. Once we are in cash we will wait for the next window of opportunity.

The next two weeks will be very important. Earnings guidance, the status of the virus and the reopening of our economy will be known by the end of the month. I am fairly neutral at this level and I am ready to take positions in either direction based on the outcomes.

Resistance is at SPY $285 and $288. Support is at $282.50, $280.50 and $275.

.

.

Daily Bulletin Continues...