Market Will Decline Soon – Oil Is An Example of What’s To Come

Posted 9:30 AM ET - In the last two weeks the market has been in a fairly tight trading range. The tiny bodied candles are a sign that the rally is running out of steam. Oil prices have dropped to historic lows and the May contract is in negative territory. Producers have to pay to have the oil taken away in an effort to prevent capping the wells. This is only one example of what's to come. The Coronavirus shut down will have any far-reaching consequences. Buyers will remain engaged while mega tech stocks report earnings, but I sense that the market bid is softening.

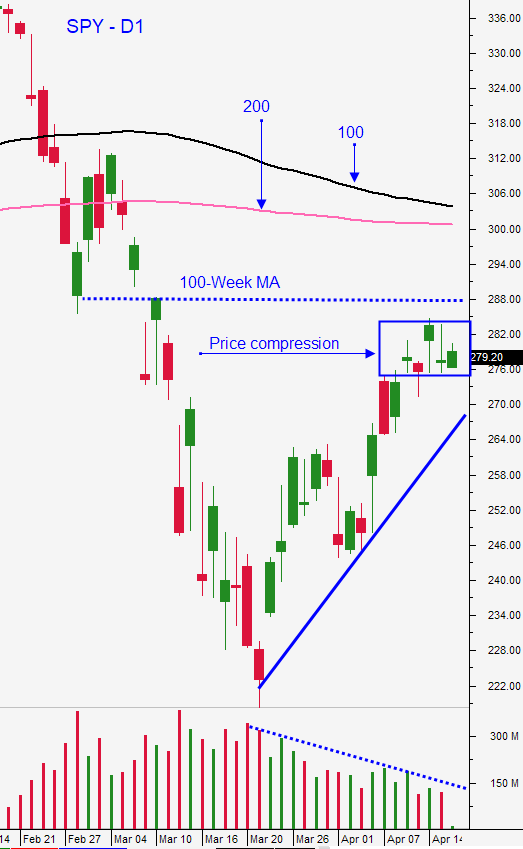

The S&P 500 rallied to the 100-week moving average ($288) and that was my first target. We took profits on our SPY position and the vast majority of our naked puts expired last week (maximum profit). On a swing basis, we are largely in cash waiting for the next opportunity.

Experts had projected an improvement in the spread of the virus and the market bounced in anticipation of this news. Before any meaningful rally could take place, we needed to see a decline in new cases. Now that conditions are improving on that front, the hard work will begin. The economic destruction reminds me of a tornado.

The longer the economic shutdown continues, the greater the chances for a credit crisis. Over $6 trillion has been committed to stimulus and we haven't even returned to work. Industries will be changed forever (teaching, healthcare, travel, energy, entertainment…). During this process I am expecting to see lots of corporate casualties.

Coca-Cola reported a 25% drop in volume so far in April. Earnings season is unfolding and 20% of the S&P 500 will report this week.

Consumers will change their spending habits. They will wait until they know their jobs are secure before they open their wallets. J.P. Morgan Chase and other banks are increasing their bad loan write-downs.

Swing traders should largely stay in cash. Buy back naked puts that are trading for pennies and release the margin/reduce risk. In recent swing trading videos I highlighted bearish call spreads (DE, AAPL, DIS, and JPM). I believe that the market will try to tread water for the next week ahead of mega tech earnings, but it will struggle. With each passing day I grow a little more bearish and I like selling out of the money call spreads here.

Day traders need to wait for support this morning. I believe that the selling pressure could be fairly heavy today and we will test support at SPY $275. This drop will strip away all of the gains from the last two weeks. If we see consecutive long red candles closing on their low in the first 30 minutes it will be a sign that this is a bearish trend day. If there is a mix of candles in the first half hour we are likely to see a bounce. Use the early market drop as an opportunity to find stocks with relative strength. We are still seeing a handful of extremely strong stocks with great momentum early in the day. These have produced nice winners for us and we may have that set up this morning. Set passive targets and take profits. Don't overstay your welcome in long positions. Once the bounce runs its course I will be looking for relative weakness and I plan to short the early bounce when it runs out of steam. The exception would be consecutive long green candles closing on their high. If I see this I will hold off on shorting. Stay fluid and use the one OP indicator as your guide.

I believe the market is going to probe for support during the next few weeks. Be very careful with your bullish swing trades.

.

.

Daily Bulletin Continues...