Small Business Stimulus Needed – Market Momentum Is Stalling – My Bias Is Changing

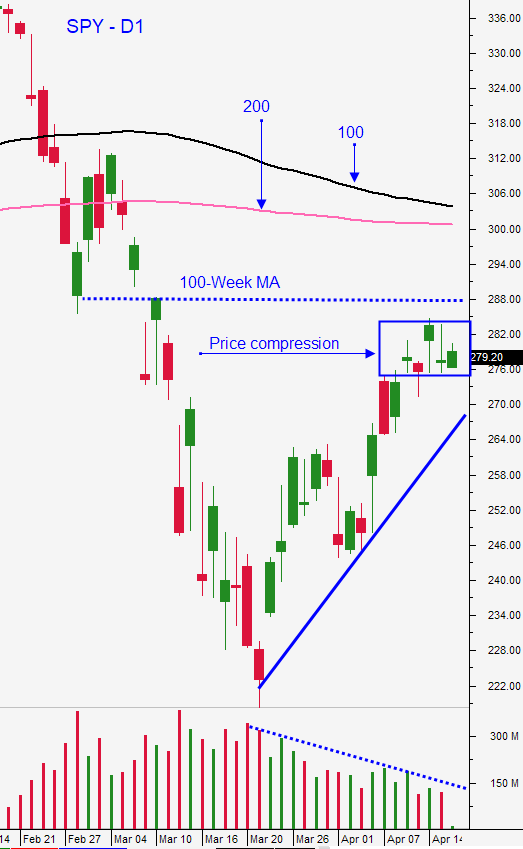

Posted 9:30 AM ET - Yesterday the market saw heavy selling pressure and the gains from the last two weeks have been erased. The upward momentum that we have seen during the last month is stalling and investors are waiting to see if the shutdown will end as scheduled. Businesses need to reopen immediately and the speed of the economic recovery is unknown. Earnings guidance is providing a limited look into the future and many companies are still trying to assess the damage. The S&P 500 will struggle to advance and resistance is building.

Netflix and Snapchat posted strong numbers after the close yesterday. The Coronavirus will help most of the mega cap tech giants (Google, Facebook, Amazon, Twitter and Microsoft) and these earnings will be posted in the next two weeks. Sellers are typically passive during the early part of the earnings cycle, but the pressure will build towards the end of April. Energy, retail, financials, transportation and industrial sectors have been hit particularly hard. The shutdown needs to end promptly and businesses need to immediately restart operations to avoid a credit crisis. Each passing week makes the recovery exponentially more difficult and the $6 trillion government stimulus program will quickly run out of steam.

Consumers will not open their wallets until they know that their jobs are secure. This will slow the economic recovery and we can expect a longer hard road ahead.

Swing traders should largely be in cash. In the last week we have taken profits on the vast majority our naked put positions and we sold our SPY position for a 25% profit. We have also started selling bearish call spreads. In tonight's Weekly Swing Trading Video I am likely to highlight a mix of bullish put spreads and bearish call spreads. They will have a slightly bearish bias and where possible I will focus on post-earnings plays. Option Stalker will help me find them. We still need clarity and it will improve in the next few weeks. Until then, we need to be relatively passive with our swing trades. The goal right now is to distance ourselves from the action and to generate excellent income from time decay and a collapse in option implied volatilities.

Day traders need to be patient on the open. The S&P 500 is likely to challenge the high from Tuesday. If we can get through that level we will fill in some of the gap from yesterday. If we see consecutive long green candles closing on their high in the first 30 minutes of trading this scenario could play out. I view this as very unlikely and I believe that the market will initially stay in the range from yesterday. The SPY will make a few attempts to get back into that gap and we might see a late day rally. Congress approved another tranche of funds for small businesses and that is fueling the early rally.

In my opening paragraph I mentioned that the market momentum is starting to slow down. That means that the intraday ranges will compress and that the early action will be relatively choppy as buyers and sellers pair off. We need to be patient and wait for the moves to set up.

.

.

Daily Bulletin Continues...