Take Profits On Long Positions – I’m Getting More Bearish With Each Passing Day [Here’s Why]

Posted 9:30 AM ET - The S&P 500 has not moved much in the last two weeks and the upward momentum has stalled. The market is resting right in the middle of its range for the last two months and Asset Managers are waiting for clarity. The spread of the Coronavirus is starting to decrease, but we don't know when the economic recovery will begin or how quickly activity will return to normal levels. Earnings guidance will provide some clues, but corporations are also in the dark. I believe that the last leg of this rally will run its course in the next two weeks while mega cap tech stocks report. After that I believe that support will be tested.

The energy sector has suffered greatly and oil futures have been in negative territory for the first time ever. This is one example from one industry and we are likely to see similar warning signs from other industries in the next few weeks. Financials, retail, restaurants, industrials, home building and transportation companies will take the brunt of the blow. The longer the shutdown lasts, the greater the likelihood of credit issues.

Treasury Secretary Mnuchin believes that the economy won't return to normal until September. If he is right, this recovery will take way too long. Rumor has it that the second tranche of small business loans has already been used up. We aren't even "open for business" and the $6 trillion stimulus is already running dry. For the market to maintain current price levels the shutdown needs to end May 1st and businesses need to reopen immediately. I am only referencing this from an economic standpoint, not a health standpoint. The small business loans will help the recovery and in essence this money is a transfer payment from the government to workers.

Flash PMI's were horrible this morning and they ranged in the mid to high 20s. A reading below 50 indicates contraction and bad news was expected. The EU now believes that GDP will decline by 10% this year (previously -7.5% expected). The ECB is now accepting junk bonds (BBB-) for collateral. European banks were never forced to take write-downs and now the central bank will shoulder this risk. This is an act of desperation.

As I conduct my research, I see very concerning issues across the globe. For the last few decades central banks have been building a house of cards. Credit at all levels (consumer, municipal, state, government and corporate) has been stretched to its limits. The only way out is to print money and the presses are running at full capacity.

Swing traders are largely in cash. Last night I posted my Weekly Swing Trading Video and I highlighted bearish call spreads and bullish put spreads. My bias is slightly negative and I will turn more bearish with each passing week. The best swing trading strategy right now is to sell out of the money options credit spreads. They take advantage of time decay and a decline in option implied volatilities. Stock selection is critical and Option Stalker helps us find the best candidates. We will gradually increase our exposure after earnings announcements. These windows of opportunity will increase next week as earnings season hits its climax.

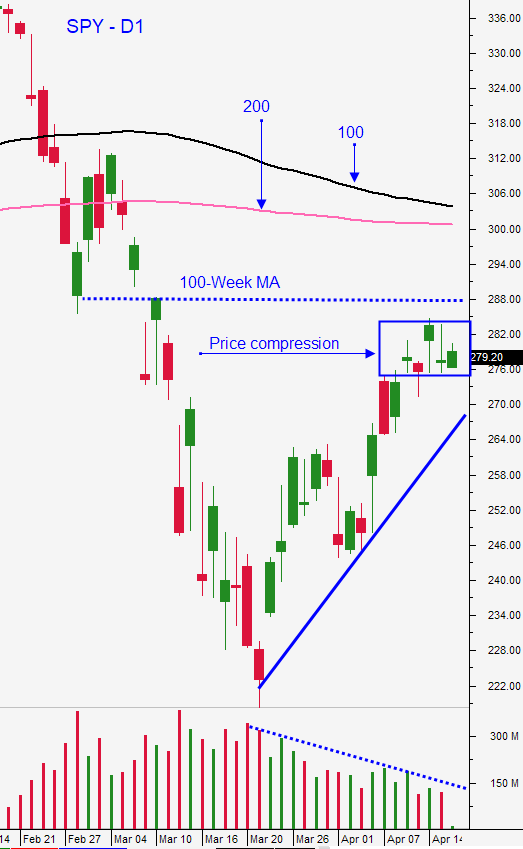

Day traders should expect fairly tight intraday ranges. The daily chart shows us that the upward momentum has stalled and the "dojis" are a sign that intraday ranges are compressed. This means that we need to patiently wait for our windows of opportunity. Look for trades on both sides of the market. I am still seeing better price movement on the long side. Stocks that are moving higher have been able to sustain the rally and the price action is much more predictable. Near the open, look for relative strength and consecutive long green candles closing on their high. Ideally these stocks also have heavy volume. Relative Strength 30, Heavy Buying, Bull Run and After Earnings Bull are my favorite searches.

Resistance is at $281.50, $285.60 and $288. Support is at $277.50 and $272.

The market is likely to move higher the next 10 days, but resistance is building and the headwinds will be stiff.

.

.

Daily Bulletin Continues...