Short the SPY If It Hits This Level – Resistance Will Start To Build [Here’s Why]

Posted 9:30 AM ET - The S&P 500 is struggling to find direction at the midpoint of its two month range. Asset Managers are hoping for clarity as earnings season ramps up, but corporate guidance is very limited. Consumers and businesses don't know when the shutdown will end or the speed of the economic recovery. The longer the lockdown lasts, the greater the chances for a credit crisis. I believe that the market has one more limited leg higher before we see another wave of selling.

President Trump is reluctant to reopen the economy and he believes that a very gradual approach is best. He has publicly voiced his concerns with states that plan to reopen now. Many states (Illinois, Wisconsin and New York) are extending the lockdown. Treasury Secretary Mnuchin said that he does not expect an economic recovery until the end of August. These timelines are being pushed back and that raises the odds of a credit crisis.

Central banks are printing money as fast as they can. Interest rates are at 0% and they are backed into a corner. Credit across the spectrum (consumer, municipal, state, corporate and sovereign) is at record highs and cash reserves are low. The average worker can't shoulder being laid off for a few weeks. They need immediate assistance to tie them over and the small business loan program is a transfer payment from the government to workers (businesses are the middleman). Last night the House approved an additional $484 billion for the small business loan program and banks are saying that this money is already spoken for.

This is situation is not unique to the United States, we are seeing money printing and credit issues around the globe. Yesterday, the ECB said that it will now accept junk bonds (BBB- rating) as collateral from banks. Risk is clearly being shifted from the private to the public sector. There are credit warning signs.

Treasury Secretary Mnuchin wants to make sure that the government has an equity stake for companies in need of bailout money.

Earnings season is unfolding, but those numbers are backwards looking. The majority of Q1 took place when the lockdown was unfolding. Corporate guidance is very murky and some companies are not even providing it. It will be hard for them to invest in plant and equipment when they don't know what the future holds. Asset Managers will also be careful with their investments and the market bid will dry up. Corporations are reducing/eliminating dividend payments to preserve cash and share buybacks have been postponed. This will also weaken the bid.

Sellers are typically passive ahead of mega cap tech earnings and many will announce next week. Once these companies report, I believe the "air will be let out of the balloon" and the market will retrace. The Coronavirus has been very resilient and the lockdown is going to last longer than expected.

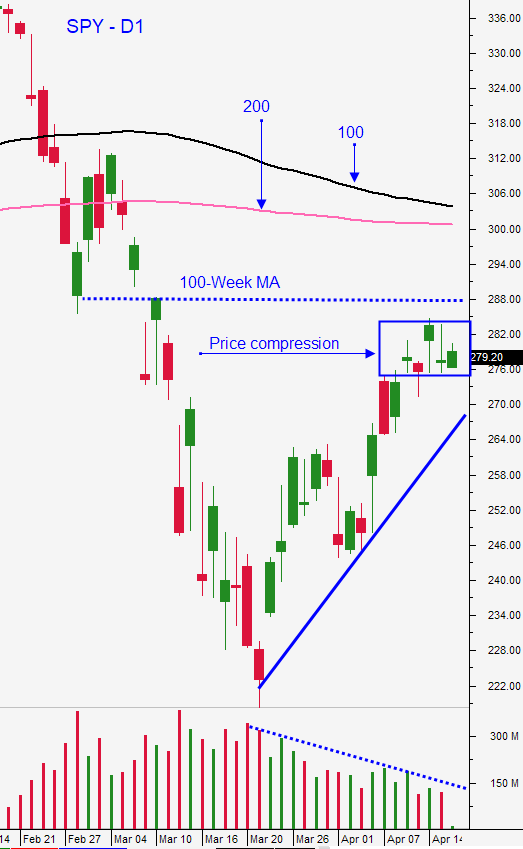

Swing traders should place an order to short the SPY at $287.50. This will only be 1/2 position. In the unlikely event that we rally to SPY $300 I want to be able to add. If we see a technical breakdown in the next two weeks we will add the second half of the position. In the weekly swing trading video we have been distancing ourselves from the action and we have been selling out of the money bearish call spreads on weak stocks and out of the money bullish put spreads on strong stocks. We want to take advantage of time decay and a decline in option implied volatility. Next week, earnings season will climax and we will have many post earnings opportunities. I plan to get a little more aggressive after next week.

Day traders need to be relatively cautious. The opening gap higher this morning will put us squarely in the middle of yesterday's trading range. On a daily chart you can see lots of tiny bodied candles (dojis) and that is a sign of equilibrium. The market has not moved much in the last two weeks and the intraday ranges are relatively contained. Resistance is at SPY $284 and support is at $277. We will stay within that range today and you should look for opportunities to play reversals as we reach those extremes. Yesterday, we saw fairly heavy selling once the high was established in the first 90 minutes of trading. I don't believe we will see a meaningful rally this morning until the bid has been tested. I have still been able to find better day trading opportunities on the long side. Look for relative strength early in the day and monitor your "wish list" when the market dips. Stocks that are able to tread water or move higher will be your best candidates for long positions. Wait for market support and buy these stocks. The majority of our money has been made early in the day. Take profits and go to cash. We may see another opportunity later in the day and as always I will be looking for "option lottery place" later in the day. We will try to buy options that expire today and that only have a few minutes of life left. I will be looking for momentum and stocks that have a chance to cross the strike price so that the options go in the money. Expensive option implied volatilities and wide bid/ask spreads have prevented us from using the strategy in recent weeks, but conditions are improving.

Look for one more market move higher in the next 10 days and an opportunity to get short after that.

.

.

Daily Bulletin Continues...