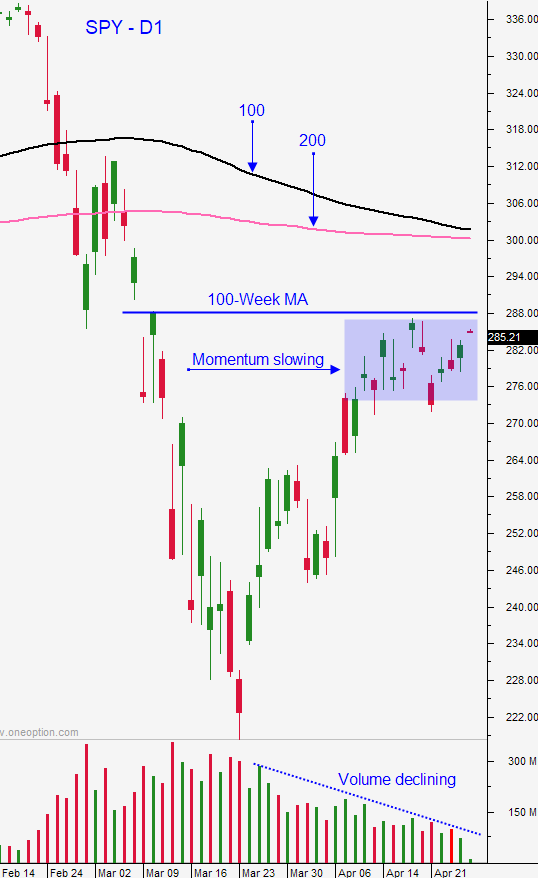

Market Stages Final Push Higher – Add To SPY Short Position At This Price

Posted 9:30 - Yesterday the market gapped through resistance at SPY $288 and it looked like we were off to the races. Sellers instantly slapped that move down and we had an intraday reversal with the S&P 500 closing near its low of the day. This resulted in a price pattern that was very close to being a bearish engulfing pattern. Sellers are getting anxious and I believe that the upside rewards are smaller than the downside risks. After mega tech stocks announce earnings this week I believe that optimism will wane.

Earnings season is in high gear and Google reported excellent results after the close yesterday. Revenues were up 13% and it benefited from the Coronavirus. Microsoft, Amazon, Facebook and twitter will post results in the next two days and I believe that they will also benefit from the virus. Unfortunately, these companies are not representative of the entire S&P 500. I believe that as earnings season unfolds we will see that the damage is extensive. Q1 was only marginally impacted since the shutdown happened in the last few weeks of the quarter. Asset Managers were hoping for clarity and they aren't getting it since most corporations are not providing forward guidance. Most companies are saying that Q2 will bear the brunt of the blow. As I review the reactions to overnight earnings announcements I see that the majority of the stocks are trading lower on the news.

Many corporations are preserving cash. Dividends are being cut and stock buyback programs are being postponed. This will soften the underlying bid to the market.

This morning we learned that advanced Q1 GDP fell 4.8% and that was worse than expected. Official PMI's will be posted Friday along with ISM manufacturing. With the entire nation shut down, data is difficult to collect and I question the reliability of these reports. Most of the releases are backward looking and I believe that they are understated.

The FOMC statement will be released this afternoon and it will be dovish. The Fed is doing everything it can to avoid a credit crisis. They are purchasing municipal bonds ($500 billion), but they want municipalities to first look for financing from banks. Property taxes are coming due and I believe there could be a real credit crunch on a local basis. In a recent poll I read that half of the respondents can't afford to pay May's rent. Credit is the primary concern across the spectrum (consumer, municipal, state, sovereign and corporate).

Yesterday I saw retailers, airlines and auto manufacturers rally. This is overly optimistic. Just because car manufacturers are planning to reopen, it doesn't mean that consumers are going to purchase a new car. I believe that workers are going to evaluate business conditions and job security before they start spending. From an economic standpoint we needed to be off and running on May 1st and that timeline has been pushed back by a month. I believe that the credit wheels will start to wobble.

Swing traders are short 1/2 position of SPY at $288. We will look to add the other half at higher levels. Place an order to short the SPY at $299.95. Our risk exposure on option spreads is fairly limited at this time. Tonight I will post my weekly swing trading video and I plan to highlight post-earnings bearish call spreads and bullish put spreads. As I'm writing my morning comments I am watching the S&P 500 grind higher and the futures are up 45 points. We are likely to test the highs from yesterday this week and we could even challenge $300 if the tech giants post good numbers. With each passing day I grow a little more bearish, but I need to see technical confirmation before I can aggressively short stocks for swing trades. This rally is fairly strong and it will be hard to turn. Sellers will surface when the reopening starts to struggle and that could take a few more weeks.

Day traders need to wait for the bid to be tested this morning. I mentioned that in my comments yesterday and the gap higher to a relative high was faded immediately. The market spent the rest of the day drifting lower and we could see a repeat performance today. A few weeks ago we saw a pattern where a bearish engulfing candle off of a relative high was followed by a long green. That was at a much lower level and I don't know that we will see that repeat when we are near a major resistance level. I am starting to see slightly better price action on shorts and that tells me that stocks might be getting overextended. To this point I have been favoring the long side. We will wait for 1OP spikes and troughs and trade those reversals during the day.

Optimism ahead of the FOMC statement and earnings from tech giants will attract buyers today. The strength of this move will help me gauge how much gas is left in the tank. I believe that we have one more nice push higher coming and then resistance will form quickly. When the economy does not recover quickly, optimism will fade. Good news is priced in.

.

.

Daily Bulletin Continues...