Great Earnings From Tech Giants Will Fuel Optimism – Here’s Why You Need To Be Careful

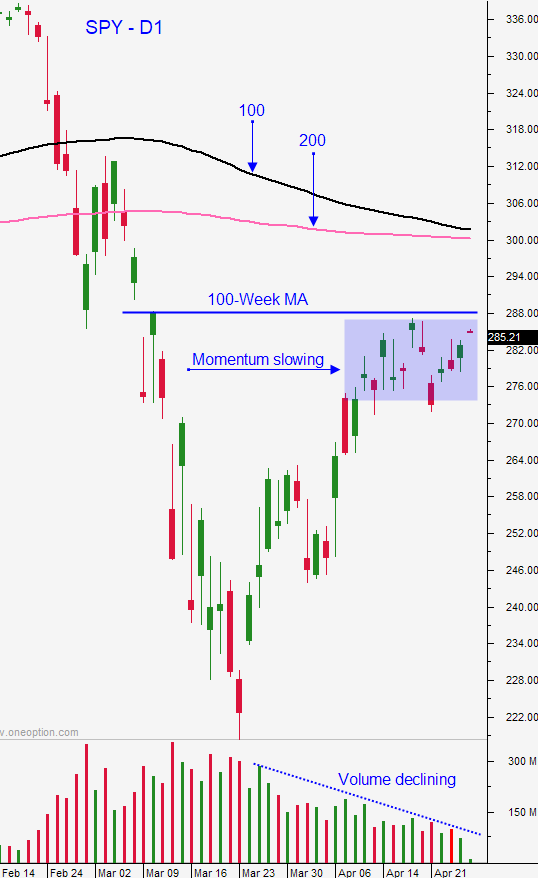

Posted 9:30 AM ET - Yesterday the market rallied to a new relative high on optimism that tech giants would post excellent earnings. Microsoft, Facebook, Tesla and Twitter delivered yesterday. After the close today, Apple and Amazon will report. These earnings releases will spark optimism and the SPY could challenge major resistance at $300. I believe that this final push higher will be a buying climax.

Unfortunately, these tech giants don’t represent the other 90% of the S&P 500. In many cases tech has benefited from the shutdown. During the early part of the earnings cycle, Coronavirus had only impacted a few weeks’ worth of results. As companies report in the next few weeks their results will include more of the impact from the shutdown. The back half of earnings season is filled with sectors that have suffered from the shutdown (industrials, energy, retail and services). Asset Managers were hoping that corporate guidance would provide clarity and many companies are not providing it. The one recurring theme that I'm reading from all of the earnings announcements is that Q2 will be much worse than Q1.

Today is the scheduled end of the national shutdown. If businesses were ready to reopen tomorrow and consumers were ready to re-start their lives, we would have a chance to avoid a prolonged recovery. Unfortunately, this is not the case. States are still very reluctant to end the shutdown and in many cases it has been extended. The phased reopening of our economy will happen slowly and credit issues will start to surface. The $6 trillion stimulus program will be spent instantly and this "bridge loan" won’t provide enough coverage. The Fed’s war chest is empty and the country needs to get back to work right away.

The PPP stimulus plan will temporarily get people back on the job. When workers don't see the foot traffic or new orders, they will question their job security and they won't resume their previous spending habits. I hope I'm wrong, but this recovery is going to take longer than expected.

The economic data has been weak and it is backwards looking. Many agencies have been closed and the data has been hard (if not impossible) to collect. I believe that most of the numbers are grossly understated and that conditions were worse than reported.

Swing traders are short 1/2 position at SPY $288 and they should have an order working to short at SPY $299.95. In this week's Swing Trading Video I highlighted very short-term bullish put spreads. I still believe that the market has some upside and if we keep the spreads inside of two weeks I believe we will be in good shape. As I start to see resistance form, I will start selling out of the money bearish call spreads. We can't get more aggressive than that with our shorts until we see technical confirmation (technical breakdown).

Day traders should wait for market support this morning and find stocks with relative strength during the drop. The earnings news was good and I believe we will see a bounce early in the day ahead of major earnings announcements this afternoon. Set targets and take profits on the bounce. Once you are back in cash, wait for the next opportunity. In the last few days I have been able to find nice intraday shorting opportunities. This has changed recently. In the past few weeks every short was a loser and the price action was very choppy on the downside. This tells me that market conditions are changing and that many stocks are overextended on the upside. I've also noticed that "the dogs are barking". This term is used when laggards start to rally and this typically signals the end of a bullish run. Be flexible and look for opportunities on both sides of the market. I still believe that we have some upside and we need to watch for intraday clues of selling pressure. Late day selling and follow through the next day would be the first warning sign.

Support is at SPY $290.50 and $288. Resistance is at $294 and $300.

.

.

Daily Bulletin Continues...