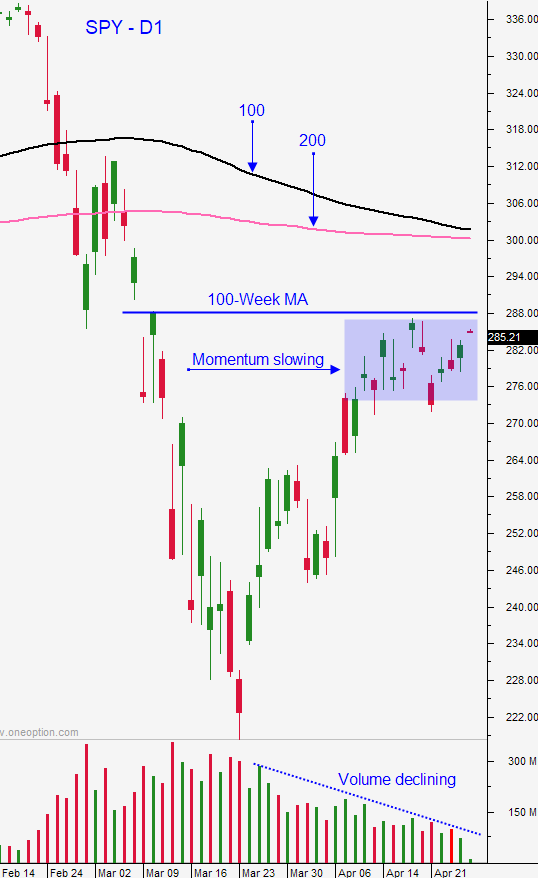

SPY Could Test $300 In the Next Week – Resistance Will Build Very Soon [Here’s Why]

Posted 9:30 AM ET - Yesterday the market gapped higher to start the week and it challenged resistance at SPY $288. It was not able to get through that price level, but it will this morning. Buyers are fairly aggressive ahead of tech earnings this week and Google will post results after the close today. States are making plans to reopen and optimism is fueling the rally. Unfortunately, the aftermath from this pandemic will be severe and the recovery will be slower than expected. I believe that the market bounce will run out of gas in the next week or two.

This week over 170 S&P 500 companies will report earnings. The results have been fairly good so far, but the impact of the Coronavirus only impacted the last few weeks of the quarter. Many companies are not providing guidance because they don't know what to expect in the future. This makes it very difficult for Asset Managers to commit.

Major economic releases are slated this week (Q1 GDP, Chicago PMI, official PMI's and ISM manufacturing). This data is backwards looking and many agencies have been closed and the reliability of the numbers is questionable.

The FOMC statement will be released tomorrow. It's hard to imagine that the Fed would be anything but dovish. States (like the government) are running massive deficits and the Fed is buying municipal bonds ($500 billion). They are trying to avoid credit issues while the economy tries to reopen.

HSBC said that they will take a $3 billion write down to cover bad loans and pretax income fell 48%. "The outlook for world economies in 2020 has substantially worsened in the past two months. The impact and duration of the Coronavirus crisis will likely lead to higher expected credit losses and put pressure on revenue due to lower consumer activity levels and reduced global interest rates." I am seeing signs of credit issues and that limits how high the market can run from here.

The shutdown will end in phases and the recovery will be slow. Consumers are not going to instantly resume previous purchase patterns when they have been struggling to pay their bills. The small business loans will temporarily provide income for workers, but when they don't see customers/orders they will wonder how secure their jobs will be when the loans run out. I believe that most consumers will greatly curtail their spending.

Swing traders are short a half position of SPY. Expect to take some heat, we are early. Place an order to sell 1/2 position at SPY $300. We won't get there today, but we could reach it in the next two weeks. Earnings season will provide us with lots of action and will be looking for bearish call spreads and bullish put spreads. With each passing week our bias will get slightly more bearish. I believe that Google, Facebook, Microsoft, Amazon, Apple and Twitter will spark optimism and the market will rally. Unfortunately, these companies are not representative of the S&P 500 and I believe that most sectors are in dire straits. Once this last push higher runs its course, I expect to see some selling pressure.

Day traders need to wait for the bid to be tested. This is a technical resistance level and I expect to see some selling. I still prefer to trade from the long side and the price action has been much more consistent. Once support is confirmed, buy stocks with relative strength. Good news from the tech giants and a dovish FOMC statement should keep a good bid to the market the rest of the week.

Good news is priced into the market and investors are expecting an immediate economic recovery. I believe that sentiment is overly optimistic and that we will start to see selling pressure when companies struggle to reopen in May.

.

.

Daily Bulletin Continues...