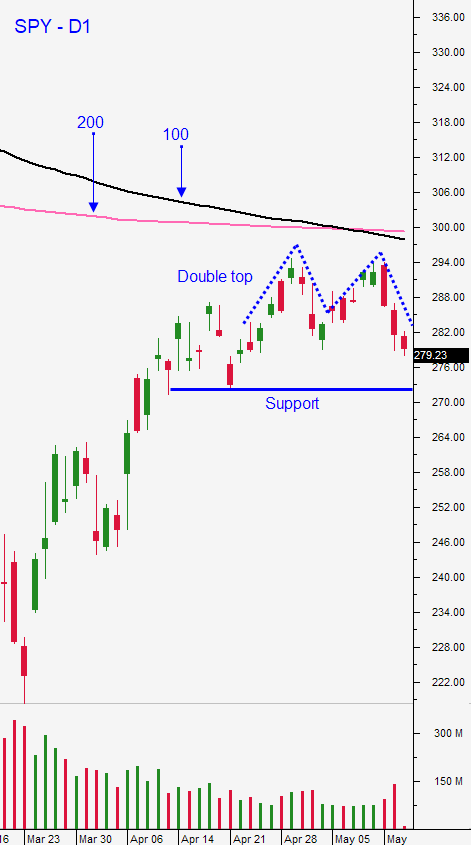

Market Will Test This Critical Resistance Level This Week [Here’s Why It Wants To Run]

Posted 9:30 AM ET - Monday the market gapped higher and it was able to hold those gains throughout the day. Buyers took a rest yesterday and we saw some profit-taking in the last hour of trading. This morning the S&P 500 is back on track and we are likely to challenge horizontal resistance once again. Best case scenarios are being priced in as our country reopens. Every state has ended the shutdown and we are not seeing a spike in new Coronavirus cases. I still believe that the S&P 500 will challenge the 100-day moving average this week.

News that Moderna's vaccine trial did not go as well as expected sparked selling Tuesday. Biotech companies around the globe are burning the midnight oil to develop treatments and vaccines. There are many promising drugs and that is what the market will focus on.

The most important news in the last week has come from states that have fully reopened. Healthcare officials were warning that a spike in new cases was likely and that has not happened. In Florida the number of new cases during the last week has declined by 14% and in Georgia the number of new cases during the last week has declined by 12%. This has given other states the confidence to scale up their reopening efforts and I believe that this development is much more important than a vaccine.

The only way that we avoid a credit crisis is to get back on track immediately. Businesses need to reopen and workers need to feel confident that their jobs are secure. This will spark consumer spending and pent up demand could fuel the recovery.

Asset Managers are erroring on the side of being long. Fixed income investments are producing negative real returns (inflation-adjusted) and equities are attractive given that central banks are providing a massive safety net for the market. If the recovery takes longer than expected, the Fed (quantitative easing) and the government ($3 trillion stimulus plan) will take action.

This afternoon we will get the FOMC minutes. I'm not expecting any new information. Anything that can be done is being done.

Swing traders should continue to wait for clarity. We were short an out of the money bearish call spread (WYNN) and we were able to “leg out” for profit. We are still short an out of the money bearish call spread (SHAK) and it is in good shape with 10 days left to go. We are also short two out of the money bullish put spreads and they are in good shape. Given the market strength this week, we will shift our focus to selling out of the money bullish put spreads. I will be posting my Weekly Swing Trading Video tonight and I will have four new trades. With a major holiday approaching, I don't feel comfortable buying the SPY - yet. We have two major moving averages that will provide stiff resistance and we have seen selling when the market gets ahead of itself. I still believe that selling out of the money bullish put spreads is the way to go. Option implied volatilities remain high and we will continue to take advantage of that condition. We still need clarity before I get more aggressive with my longs and we will get that over the course of the next few weeks. Selling out of the money options that expire in less than two weeks allows us to distance ourselves from the action and take advantage of time premium decay. We are able to reevaluate market conditions as the spreads expire and we can adjust accordingly.

Day traders should be patient on the open today. Gaps higher have been difficult to trade because they mask relative strength. If the market shoots higher right out of the gate we need to be very careful chasing stocks. In this scenario, I will be relatively passive. Ideally, the bid will be tested and we will get a slight market pullback on the open. That move will reveal stocks with relative strength and will be looking to buy once the market finds support. After this first wave of trades I will reduce my size and trade count. I have been making most of my money in the first few hours of trading and I have not been active in the afternoon session. The price action has been much more consistent in the morning and then stocks tend to settle in. With each passing day the volume will decrease as we prepare for a three day weekend. If by chance we get a nice afternoon market drop I will consider buying a reversal once support is established on the notion that stocks will finish strong. A close today above SPY $295 would be bullish and there's a good chance we could test the 100-day moving average.

Favor the long side and watch for a test of the 100-day moving average. Support is at $294 and $292. Resistance is at $297 and $299.50.

.

.

Daily Bulletin Continues...