Market Gains Held Yesterday – The Bid Is Strong and So Is Resistance – Use This Option Strategy

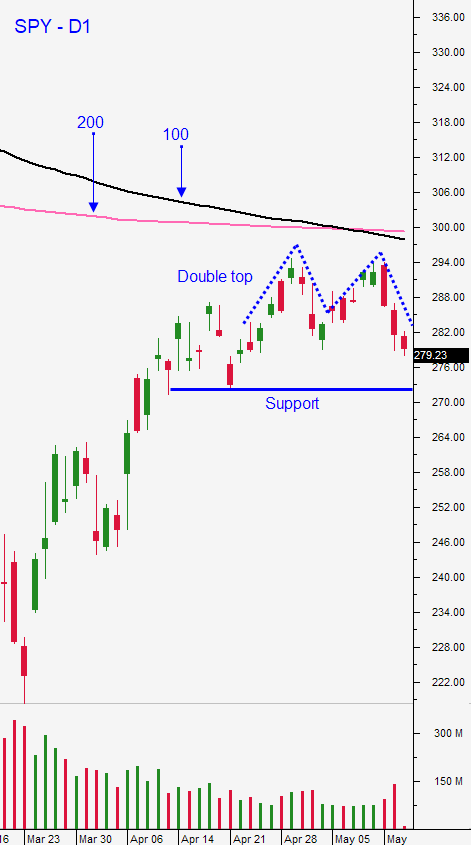

Posted 9:30 AM ET - Yesterday the market surged higher and it challenged technical resistance at SPY $295. The opening gap higher held throughout the day and buyers were encouraged by the economic reopening and by a promising vaccine developed by Moderna. The 100-day moving average is within striking distance and we are likely to test it this week.

Asset Managers are relying on a safety net provided by the Fed. In a 60 Minutes interview last Sunday, Jerome Powell said that the Federal Reserve still has plenty of firepower left in the war chest to get the economy back on its feet.

The House passed a $3 trillion stimulus plan, but it is likely to stall in the Senate. Republicans want to see if the stimulus to this point takes root. In the next few weeks they will monitor the progress and evaluate the shortcomings (waste) of the current plan. They want to make sure that the money is being used where it is needed the most. Small businesses and workers are the primary concern.

Global interest rates are at historic lows and bond yields do not keep pace with inflation (negative real returns). This is forcing investors out on the risk curve and it is creating a strong market bid.

States are reopening their economies and healthcare officials are worried that the virus will start to spread again. Media is reporting that states that have reopened are seeing a surge in new cases. That is simply not true. In Georgia the number of new cases fell by 12% and in Florida the number of new cases declined by 14% compared to the previous week. People are still practicing social distancing and companies have been very creative in protecting workers.

Moderna had very positive test results and their vaccine has had very few side effects. It stops the virus from replicating and the company believes that it can have 300 million doses available before year-end.

The virus is going to have a major impact on businesses. In the retail sector we are seeing two extremes. Walmart is reporting its best quarter ever while Kohls reported a 44% decline in sales. Stores that remained open and that were deemed essential will prosper. In general, companies are not providing guidance because they don't know what to expect. The consensus among CEOs is that Q2 will be much worse than Q1.

The weather is getting warmer and people want to resume their normal lives. In the next month we will see if consumer demand is back on track or if consumers are tightfisted. In order for the economy to get back on its feet, spending needs to be brisk and we need to see pent-up demand.

Swing traders should continue to focus on selling out of the money options spreads. The price action yesterday tells me that we should be more cautious selling out of the money bearish call spreads. The market was able to quickly bounce off of the low end of the range last week and it surged to the upper end of the range. If these gains hold for another day or two we will challenge the 100-day moving average and we might even challenge the 200-day moving average ahead of the major holiday. I like selling out of the money bullish put spreads on tech stocks. Tech has been much stronger relative to the rest of the market. The NASDAQ 100 has been above the 200-day and the 100-day moving average for more than a month and it continues to lead the way.

Day traders should wait for the bid to be tested this morning and they should be looking for relative strength. I believe that the market will grind higher once support is established. After the first few hours of trading, the market is likely to fall into a tight trading range. Try to make your money early in the day and reduce your size and trade count in the afternoon session. Use SPY $295 as your guide. Strangely, I made my money on the short side yesterday. Stocks that were moving higher were barely moving after the huge initial surge. Stocks that were overextended retreated and relative weakness was easy to spot. The momentum in these stocks was strong and traders were taking profits and rotating into cyclical stocks. Once these stocks started to decline, the momentum accelerated. The market is still in a trading range and I encourage you to look for trades on both sides during the day. I still prefer the long side, but if that were my only focus yesterday I would've missed some great opportunities.

The trading volume will decrease and intraday ranges will compress as we get closer to the holiday weekend.

Support is at SPY $293 and $286. Resistance is at $297.20 and $300. A close above $295 today would be bullish.

.

.

Daily Bulletin Continues...