Buy Stocks With Relative Strength This Morning – Market Will Rally Into Holiday Weekend

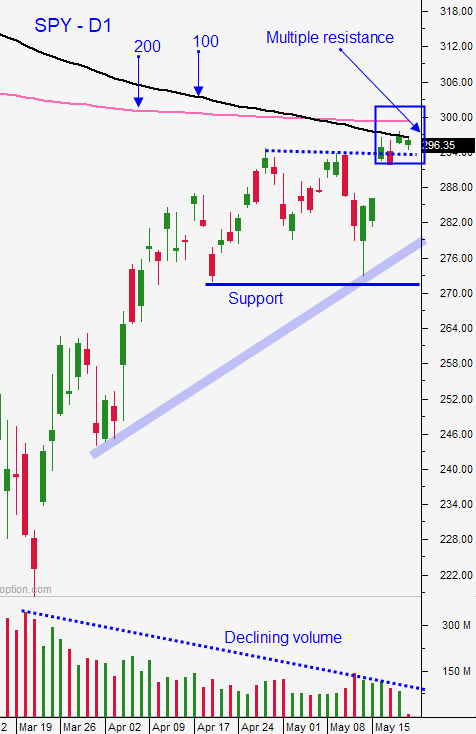

Posted 9:30 AM ET - This week the market has rallied to the upper end of its trading range and it is trying to get through major horizontal resistance and the 100-day moving average. Investors are encouraged that states are reopening and that the number of new Coronavirus cases is not spiking. The Federal Reserve is providing a safety net and Asset Managers are erroring on the side of being long. I believe the S&P 500 will finish the week above its 100-day moving average.

Rhetoric between China and the US is heating up again and the S&P 500 is down 14 points before the open. President Trump is blaming China for a virus cover-up and he believes that the pandemic could have been avoided if proper steps would've been taken early on. This event has been eye-opening and our dependence on China has been brought to light. President Trump will provide tax incentives to companies who move manufacturing back from China. We can expect this bluster to increase into the election.

Denmark has been lifting restrictions for well over a month and there has not been an appreciable increase in new Coronavirus cases. Similarly, Florida (-14%) and Georgia (-12%) have seen a reduction in new cases during the last week after reopening their economies. Other states are watching carefully and they are progressively removing restrictions. Workers are protesting the shutdown and they want to return to their jobs.

Flash PMI's were dismal this morning and that was expected.

The FOMC Minutes revealed that the Fed stands ready to take action if the economic recovery is sluggish. A $3 trillion stimulus plan has been passed by the House and the Senate is not holding any meaningful talks. Republicans want to gauge the success of the current programs and they want to plug the holes (abuse and waste) before they pass another stimulus plan. Asset Managers are taking comfort in this safety net and the market bid is strong.

There isn't any incremental news. The economic reopening and the potential for pent-up consumer demand is fueling the market rally. Beaten-down sectors like travel and entertainment are attracting buyers.

Swing traders should sell out of the money bullish put spreads. And last night's Weekly Swing Trading Video I featured 4 new trades and they focused on stocks that have relative strength. This week we had to buy back our two bearish call spread positions. I did not expect a market rally with the strength that we've seen this week. We closed one of the trades for a profit and we will try to do the same with the second trade today. We still want to distance ourselves from the action because the potential for a market dip exists. An increase in new Coronavirus cases, a sluggish economic recovery, a trade spat with China or a lack of consumer buying could spell trouble in the next few weeks. Selling out of the money bullish put spreads on strong stocks allows us to distance ourselves from the action and we can take advantage of time premium decay. The price action into a holiday tends to be bullish and I'm expecting the S&P 500 to close above its 100-day moving average Friday.

This morning the futures are trading slightly lower and that will give us an opportunity to identify relative strength. Look for strong stocks and buy them once market support is established. The trading volume will be light heading into Memorial Day and the first round of trades today will produce my profits for the day. I prefer to trade from the long side and we will have a good opportunity to do that this morning. Unless we get a nice market move later in the day, I plan to be sidelined. Yesterday we saw very choppy/directionless trading after the first three hours. The market did not have any pace or direction and you can see that from the mixed green and red candles during the afternoon session on a 5 minute chart. I consider this a low probability day trading environment. Keep your size and your trade count down the rest of the week.

Support is at SPY $292 and $295 and resistance is at $297.60 and $299.50.

Look for quiet trading with an upward bias today and tomorrow.

.

.

Daily Bulletin Continues...