Market Breakout and Follow-Through Today – Use the 200-Day MA As Your Guide

Posted 9:30 AM ET - Yesterday the S&P 500 blew through the 200-day moving average to start the week. Optimism that consumers are ready to restart their lives attracted buyers as many states ramp up their reopening. Central banks are adding liquidity and governments are increasing fiscal stimulus. This morning we are seeing follow through and the S&P 500 is adding to yesterday's gains.

Japan announced a $1.1 trillion stimulus plan and Mitch McConnell said that another US stimulus plan is likely. The EU unveiled its intentions to borrow €750 billion to aid in the economic recovery. In short, central banks are printing money like mad to get the economy back on track. This safety net has emboldened buyers.

Coronavirus fears have subsided and based on my observations from the holiday weekend, I believe that there will be pent-up demand. People are getting out and they are shopping. Social distancing is barely being observed, yet the growth rate of new Coronavirus cases is decreasing. States are ramping up the reopening.

A year ago the market would have been concerned about escalating tension between the US and China. The Coronavirus, the delay in implementing the Phase 1 deal and China's increased control over Hong Kong have politicians considering sanctions against China. At least for the moment, investors don’t care.

China is the recovery litmus test since it has reopened sooner than any other country. This morning we learned that China's industrial profits for April fell 4.3% and that was a vast improvement from the 34.9% decline a month ago.

Asset Managers have been erroring on the side of being long. Bond yields don't keep pace with inflation (negative real returns) so money is flowing into equities.

I believe that the market rally is over-extended on a valuation basis and that we are due for a "let down" in two months when Q2 earnings are released. Some of the laggards are starting to bounce and traders need to be cautious with stocks that were heavily impacted by the shutdown. Yesterday we saw rotation out of some of the tech leaders and that money was reallocated to retail, travel, entertainment and cyclical stocks.

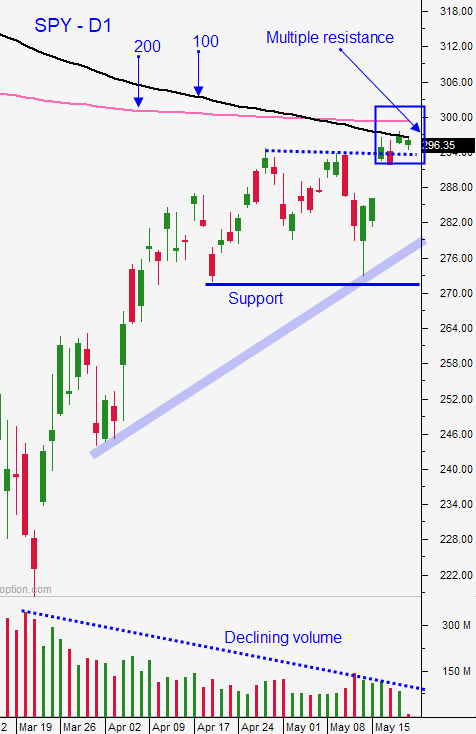

Swing traders bought the SPY yesterday at $300 per our instructions. We will continue to ride the wave higher and we will use the 100-day moving average as our stop on a closing basis. We will be looking to sell out of the money bullish put spreads on strong stocks when I release the Weekly Swing Trading Video tonight. This is still my preferred strategy since we can distance ourselves from the action and we can take advantage of time premium decay. Bullish put spreads will also benefit from a decline in option implied volatility. The market bid will remain strong while we gather information on the economic recovery during the next month.

Day traders need to be cautious on opening gaps higher. I mentioned this yesterday and the market retraced most of the day. It was able to finish near the 200-day moving average and we will see if the early gains hold today. The price action during the day has been lackluster and we may see similar today. Given the overnight gaps I believe that our focus needs to shift to swing trades. The action during the day has been fairly compressed and that is likely to continue. Our best trading setups have come off of down opens and that is when we can be more aggressive with our trades. We still need to favor the long side. We are finding decent shorting opportunities since stocks have rallied hard. Wait to see if the early market gains hold. If the market drifts lower, search for stocks with relative strength. That early dip will present an excellent buying opportunity if it materializes. I am day trading smaller size when the market gaps higher.

Look for a gradual drift higher and for support at SPY $300 to hold this week.

.

.

Daily Bulletin Continues...