The Market Will Blow Through Resistance Today – Here’s What Changed

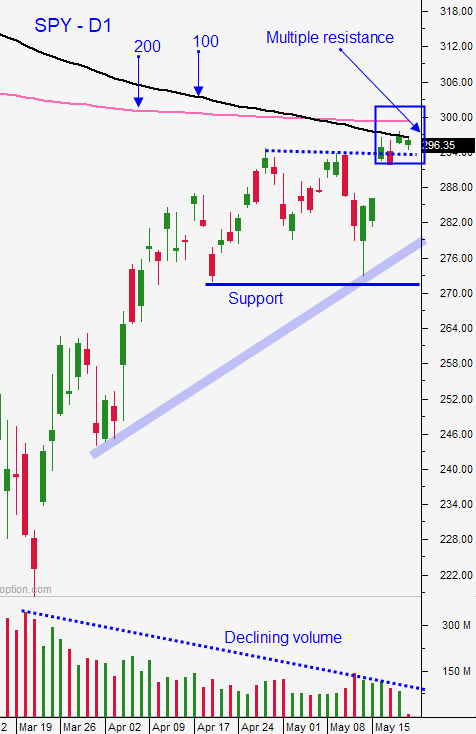

Posted 9:30 AM ET - Last Monday the S&P 500 shot up to the high end of its range and it spent the rest of the week hanging onto those gains. Optimism that a vaccine will be developed this year and that consumers are anxious to resume their normal lifestyles is fueling a massive rally this morning. The S&P 500 is slated to low through major resistance at the 200-day moving average.

There hasn't been much incremental news during the three-day weekend, but my personal observation is that people are less fearful of the Coronavirus and they are shopping and interacting like everything is normal. The stores that I visited had very few people wearing masks and two weeks ago everyone was wearing a mask. I realize that this varies state-by-state, but I sense that we could see lots of pent-up demand. I like to boat and the water was packed. There wasn't any social distancing going on and people are done with the shutdown.

The national news still highlights that new cases are on the rise, but they fail to mention that the percentage increase is declining steadily for states that reopened weeks ago.

Biotech companies are scrambling to develop a vaccine and there is promising news each week. There are so many clinical trials going on that I don't see the point of posting all of the stock symbols. Last week we saw a big rally based on encouraging news from one biotech and then we learned that the clinical results were not as good as initially expected. The market dropped and it bounced right back from that dip. This price action tells me that investors are focused on all of the promising vaccines.

I live in a state that is still shut down and I spend my weekends in one that has reopened. In both cases people seem less concerned with the virus and I sense that the level of activity and the attitude that I'm seeing in Wisconsin will also take root in Illinois when they reopened. The warm weather is everyone focused on outdoor activities and spirits are elevated.

This is the missing piece of the puzzle we've been waiting for. Based on my observations I believe that the economy could recover fairly quickly and that consumption will be back to normal by year-end. Some industries (travel and entertainment) will take much longer to recover and there will be casualties. My sample is localized and I will be looking for signs of strength across the country and the globe.

The Coronavirus is going to have a dramatic impact on profits the rest of the year and the market might be getting a little ahead of itself. Asset Managers are erroring on the side of being long and we could see FOMO (fear of missing out) if the rally continues. With interest rates at 0%, bond yields don't keep pace with inflation and fixed income investments generate negative real returns.

Swing traders can place an order to buy SPY at $300 this morning. Let's see if we get a small pullback during the day. We don't need to chase and I believe there will be plenty of opportunities for us to join the rally. We tried to enter some bullish put spreads last week and we were unable to. We will keep trying to sell out of the money bullish put spreads so that we can keep our distance from the action and so that we can take advantage of time premium decay. Option implied volatilities will also collapse as the market moves higher and option premium selling strategies will also capitalize on this contraction. We don't want to force trades. It's very important that we take positions on our terms and that we enter at favorable prices. With each passing week we will be able to monitor the global reopening and we will buy dips.

Day traders need to be cautious. Gaps higher have been very difficult to trade. If we see profit-taking on the open with long red candles closing on their low we have a chance for a reversal. If this scenario plays out it will happen in the first 45 minutes of trading. This has less than a 20% likelihood of happening. I believe the market will tread water for the first hour of trading and that the range will be fairly compressed. Stocks will gradually float higher and this could be a relatively dull day. Typically, three-day weekends produce a "holiday hangover" and the action is fairly light. Focus on stocks with relative strength and wait for a dip to enter.

Look for follow-through buying this week.

.

.

Daily Bulletin Continues...