Market Support At the 200-day Will Strengthen Every Day – Watch For Sector Rotation

Posted 9:30 AM ET - This week we've seen two massive rallies on the open and stiff resistance. Profit takers pushed the market lower after the gap up and the bid was checked. Yesterday, buyers surfaced and stocks rallied the entire day, closing on their high. The S&P 500 has rallied above key resistance levels and we should see follow-through. Asset Managers are rotating out of tech and into cyclicals. Tech stocks will be a drag on the market today.

Social media is in the government crosshairs today and fact checking regulations could be imposed by the government. Tech stocks have been leading the rally for the last two months and valuations are getting a little stretched. This morning the NASDAQ is down 100 points while the S&P 500 is up five points. Look for this rotation to continue.

Dire economic results were expected this morning and durable goods orders (-17.2%) and Q1 GDP (-5%) were slightly better than feared. These are backward looking numbers and their accuracy is in question. The market is clearly focused on the recovery and not data points from the shut down.

People want to get their lives back to normal and I believe we will see pent-up demand. States are quickly reopening and businesses are starting up. The recovery during the next month will determine market direction.

If the recovery takes longer than expected, the Fed and Congress will be ready to act. We can expect additional quantitative easing and stimulus. Senate leader Mitch McConnell has already mentioned that another stimulus package is likely.

This same process is taking place on a global basis as central banks continue to provide liquidity and as governments rollout additional stimulus plans. Yesterday, Japan announced a $1.1 trillion stimulus plan and the EU announced an €800 billion stimulus plan.

Asset Managers are erroring on the side of being long. Equities still present the best investment opportunity and they have a big safety net that is being provided by central banks. Bond yields are lower than inflation and fixed income investments are producing negative real returns. This is pushing investors out on the risk curve and the market bid is strong.

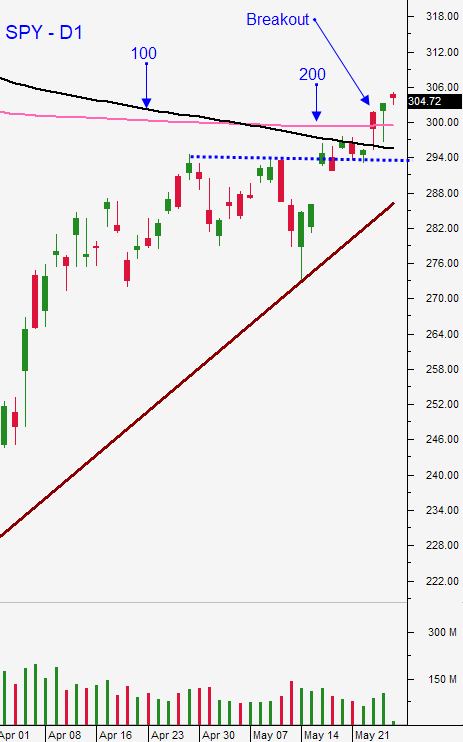

Swing traders are long the SPY at $300. Use a stop below the 100-day moving average on a closing basis. Swing traders should also focus on selling out of the money bullish put spreads on strong stocks. This strategy takes advantage of time decay and a decline in option implied volatilities. We are able to distance ourselves from the action and we don't have to worry about the intraday chop. In last night's Weekly Swing Trading Video I highlighted 4 new bullish put spreads that we will try to enter today.

Day traders should watch for early selling. The S&P 500 is up, but tech stocks are getting nailed. I believe that the early decline could set us up with a good buying opportunity. Support is at SPY $297 and resistance $303.50. We have seen resistance the last few days and there are excellent shorting opportunities during the day. Stay fluid and use the one 1OP indicator as your guide. When you see large spikes, start taking profits on your long positions. When the SPY breaks down technically, look for shorting opportunities. Exit those shorts when the 1OP indicator troughs. When we get a bullish breakout through the M5 downtrend line, buy stocks with relative strength. This is the cycle we use each day.

Look for more rotation out of tech and into cyclical stocks this week. Support at the S&P 500 200-day MA will strengthen every day that we stay above it.

.

.

Daily Bulletin Continues...