Passively Play The Market Rally Using This Options Trading Strategy – Prices Are Extended

Posted 9:30 AM ET - Yesterday the market spent most of the day unchanged and a late day surge pushed the S&P 500 to a new relative high. Stocks are up this morning and investors are focused on the global economic reopening. The virus and widespread riots are being discounted and good news is priced in. Support at the major moving averages is strengthening each day that we close above them.

This morning we learned that China's Caixin Services PMI rose to 55 and that is up from 44.4 in April. China's economy reopened in April and it is the litmus test for all other countries. They are quickly getting back on track and the threat of additional trade sanctions by the US seems minimal after President Trump's press conference last week.

This morning we learned that employment in the private sector was better than feared and only 2.76 million jobs were lost during the month of May (-11.5 million expected). ISM Services will be posted 30 minutes after the open and that will be an important number. As a survey, it is considered to be forward-looking and the service sector accounts for 80% of our economic activity.

As the economy reopens the number of new Coronavirus cases is increasing, but more people are being tested so the base is also growing. Most states are in Phase 3 and many are completely open for business. We have seen as steady decline in the spread of the virus.

Consumer spending is the key and will be tied to job security. If people feel that their employers are back on track, they will spend money. On the other hand, if they feel that they will be laid off once the stimulus is used up, they will save. The recent riots might curb some of the pent-up demand. In my opinion this is the missing piece of the puzzle and the answer will come in a month or two.

Asset Managers know that fiscal spending and loose monetary policy are providing a safety net for the market. If the recovery takes longer than expected, the Fed will run to the rescue and Congress will approve another stimulus program. With interest rates yielding negative real returns, equities remain attractive even though valuations are getting stretched.

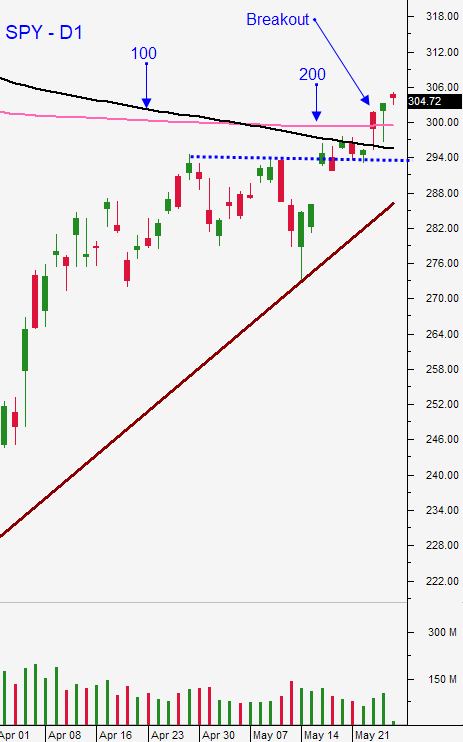

Swing traders exited the SPY at $305 this week and we took profits. I feel that the upside is relatively limited and that the recovery will have speed bumps. We will continue to sell out of the money bullish put spreads and I will be releasing my Weekly Swing Trading Video tonight. We want to take advantage of time premium decay and a decline in option applied volatilities. We also want to give ourselves some cushion in case the market hits one of those "speed bumps". As long as support at SPY $300 is intact, we will continue to sell out of the money bullish put spreads on stocks with relative strength. This strategy allows us to generate income while the market floats higher. We need clarity to determine if consumer confidence is restored. I won’t aggressively embrace this rally until I have that information.

Day traders will have opportunities on both sides. We are seeing a rotation out of tech and into cyclicals. We are using the1OP indicator to time intraday market reversals and we are buying stocks with relative strength when the market dips and we are shorting stocks with relative weakness when the market spikes. There are plenty of stocks that are over-extended and profit-taking has produced nice consistent downward movement early in the day. Opening gaps higher have been difficult today trade and we will have one this morning. If the market continues to float higher I won't be very active. I need the bid to be tested early so that I can identify relative strength. Once I get that dip I can find stocks that want to run. Gradual grinds higher that never retrace typically falter late in the day and I might have a late day shorting opportunity if this sets up. I consider this to be a low probability trading environment and I am trading half of my normal size early in the day and 1/4 of my normal size in the afternoon. The market is floating higher on light volume and I categorize this as a "seller's boycott".

Look for a bumpy ride higher and know that recent light volume gains can be stripped away very quickly. SPY $300 is a critical support level.

.

.

Daily Bulletin Continues...