Here Is My Day Trading and My Swing Trading Strategy Right Now!

Posted 9:30 AM ET - The market has been fairly resilient to all of the protests in the US. Stocks continue to float higher on light volume as global economies reopen. Central banks are printing money like mad and that safety net is boosting investor confidence. Bond yields are producing negative real returns so equities are attractive on a relative basis. I believe that good news is priced in and that stock valuations are stretched. The S&P 500 would do well to tread water this summer.

Consumer spending is the key to the recovery. If people are worried about job security after the stimulus is gone, they will save and the recovery will take much longer. On the other hand, if pent-up demand sparks consumption the recovery will quickly take root and it could feed on itself. At this juncture we don't know which scenario will play out so we have to wait for clarity.

Based on my observations from Memorial Day, it seemed as though people were anxious to get their life back on track. The riots last weekend seem to have dampened spirits and we took a step backwards. Many department stores have closed for safety reasons.

The number of new coronavirus cases and the number of virus related deaths continue to decline as countries reopen their economies. Healthcare officials are warning that we could see resurgence, but there are currently not any signs that that will happen.

Biotech companies are scrambling to develop a vaccine and there is promising news each week. Researchers believe that we would be fortunate to find a vaccine by year-end and broad-based production/distribution would be a considerable hurdle.

If the recovery is sluggish we can expect additional quantitative easing and another round of stimulus. Mitch McConnell has suggested as much and the House has already passed a $3 trillion stimulus plan. Republicans won't pass this bill, but they are open to the idea.

Corporations sense uncertainty and they are raising cash at a record pace. New shares of stock are being offered and new bonds are being issued. Companies are reducing dividends and they are delaying stock buyback programs. Most corporations are not providing forward guidance and the consensus is that Q2 will be much worse than Q1. Cash is king during times of uncertainty and I believe we should follow their lead.

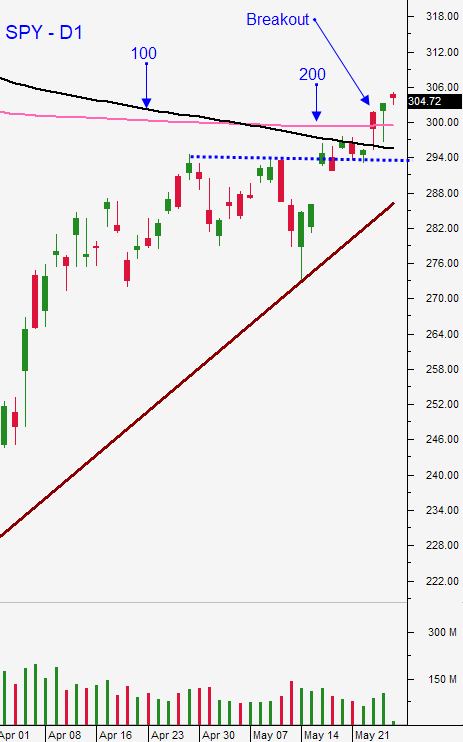

Swing traders sold the SPY at $305 yesterday for a $5 gain. I feel the upside reward is smaller than the downside risk and I feel that we have enough market exposure from our bullish put spread strategy. As long as the SPY as above $295 we will keep using the strategy and Option Stalker will help us find the best stocks. We are selling out of the money put spreads below major technical support and that is increasing our probability of success. If that support is breached, we buyback the spread and move on. This options trading strategy allows us to distance ourselves from the action and to take advantage of time decay and a decline in option implied volatilities. If the SPY breaches technical support at $295 we will buyback our bullish put spreads on the notion that the market could decline. I like to sell bullish put spreads that expire in two weeks or less so that I can maximize time premium decay. With each passing day the spreads are easier to manage and if the market does crack, we will be able to buyback most of the spreads at a gain. Short-term bullish put spreads give us the flexibility to constantly evaluate market conditions. I don't believe that the global economic recovery will go without a hitch and I am expecting speed bumps along the way. I consider this a low probability swing trading environment.

Day traders should reduce their size and their trade count. The intraday price action has been lackluster. Our best scenario is an early gap lower. Once support is established we can buy stocks with relative strength and ride the upward momentum. Gaps higher are more difficult to trade because the market is at a new relative high and profit taking can yank the rug out from under us at any time. When the market surges higher on the open, relative strength is harder to spot. In these instances we need a dip so that we can identify the "real McCoys". Sometimes we don't get that dip and the market simply floats higher. We saw this last week and I call that a seller's boycott because it is happening on light volume. These moves often see late day profit-taking and the market closes near its opening price. In the daily chart you can see small bodied candles. This is a sign that buyers and sellers are paired off. Look for a gradual float higher today and possible profit-taking in the last hour. Option Stalker searches help us find stocks with relative strength and heavy volume. We need heavy volume to fuel sustained moves so make sure that you include this variable in your searches. The Bullish Explosion search has been producing excellent candidates.

This is a heavy week for economic releases, but they are backward looking and they are not having of an impact. Consumer spending during the next two months will determine market direction and we need to wait for clarity.

.

.

Daily Bulletin Continues...