Light Volume Market Rally – Take Profits Into Strength – Use This Options Strategy

Posted 9:30 AM ET - Since Memorial Day the S&P 500 has rallied almost 200 points. Optimism of a speedy economic recovery is fueling the move higher as states reopen. The threat of a spike in new Coronavirus cases and nationwide riots has not dampened spirits. Asset Managers know that quantitative easing/fiscal stimulus will be implemented if the recovery is sluggish and they are counting on that safety net. Stock valuations are stretched so we can expect resistance.

ISM manufacturing and ISM services were better-than-feared this week and as surveys, they tend to be forward-looking. ADP reported that 2.76 million jobs were lost in the private sector during the month of May and that was much better than the 11.5 million job losses that were expected. This morning’s initial jobless claims were in line with expectations. I am not expecting any surprises from the jobs report Friday.

China's manufacturing PMI and services PMI rose above 50 indicating economic expansion. Their economy reopened in April and China is the litmus test for the global recovery.

Consumer spending will determine market direction. If people believe that their jobs are secure, they will spend money and pent-up demand will fuel the first leg of the recovery. Conversely, if job security after the stimulus runs out is in question, consumers will save. Consumer spending is the key to the recovery and Visa reported that credit card sales were only down 5% last month compared to an 18% drop in April.

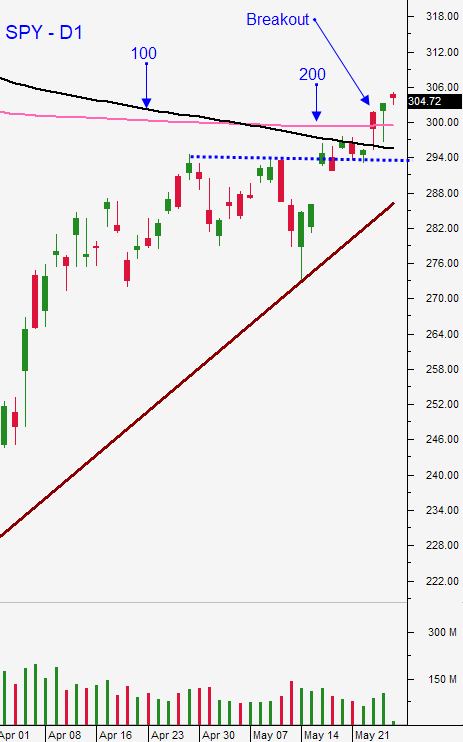

Swing traders should be focused on selling out of the money bullish put spreads. In last night's Weekly Swing Trading Video I highlighted 4 new bullish put spreads. Stock selection is critical and we are focused on relative strength. Selling out of the money bullish put spreads that expire in less than two weeks allows us to take advantage of accelerated time premium decay and we can distance ourselves from the action. We sell bullish put spreads below technical support and that increases our probability of success. If the technical support level is breached or if the SPY closes below $295 we will buy them back. This has been an incredibly successful strategy for us the last three months and elevated option implied volatilities make this an attractive options trading strategy. We won't increase our risk exposure until we have clarity. It will take a month or two to determine if the economic recovery is gaining traction.

Day traders should look for opportunities on both sides of the market. We have been using the 1OP indicator to time market reversals. Down gaps on the open have been our best day trading set up. These moves allow us to identify stocks with relative strength and when the market finds support we can join the longer-term uptrend by buying the strongest stocks. I still consider this to be a low probability trading environment and I suggest setting passive targets. Reduce your trade count and your size. The market rally this week has come on very light volume. I am trading half-size in the morning and quarter size in the afternoon.

Swing traders to try and sell some out of the money bullish put spreads to generate income, but keep your overall risk exposure to a minimum (small number of positions). We can't get more aggressive until we have a market pullback. Day traders should stay fluid and consider trades on both sides of the market. Wait for support to be established this morning and buy stocks with relative strength.

.

.

Daily Bulletin Continues...