The Dark Clouds Continue To Mount – Take Profits and Reduce Market Risk

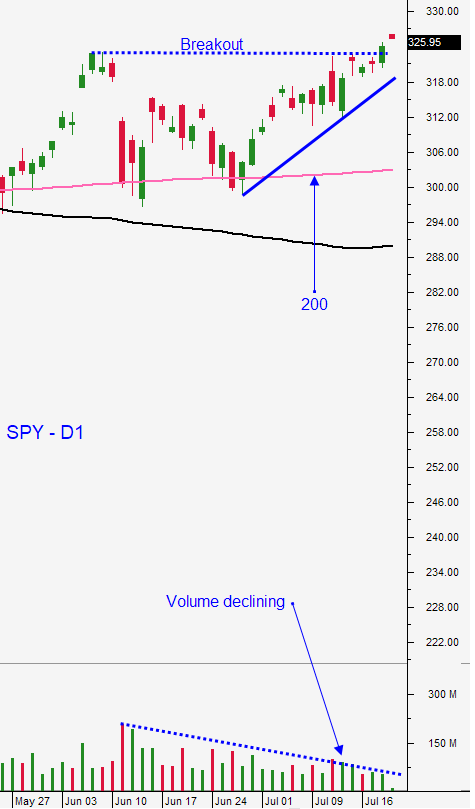

Posted 9:30 AM ET - Monday the market broke through horizontal resistance established on June 8th and it made a new relative high. Follow through buying sparked an opening gap yesterday, but profit taking stripped Tuesday’s gains away. The market bid remains strong ahead of mega cap tech earnings. Microsoft will set the tone for the tech sector when it reports after the close today. I believe that stocks will float higher for another week, but danger lies ahead. Take this opportunity to lock in profits and reduce your risk exposure.

The US has ordered China to close its consulate in Houston after two Chinese nationals were caught stealing Coronavirus intellectual property. China has vowed to retaliate and tensions are running high. Trump has blamed China for the mismanagement of the Coronavirus and the US recently removed favorable trade status for Hong Kong as China strengthened its grip on the region. Fears of a trade war are elevated.

Brexit is another trade related issue and a hard landing in England is possible. This won’t have a market impact for another month and there is still time for a deal.

The Coronavirus continues to spread and Present Trump said that conditions will get worse before they get better. Many states are considering a rollback to Phase 3 and the economic recovery will take longer than expected. Credit issues are likely to surface. More than 23 million people could be evicted in October and 12 million people did not pay their rent in May.

Politicians are haggling over the next round of stimulus and the chances of a deal by July 31st are decreasing. If they don't strike a deal before they go on recess the market will drop. They will reach an agreement at the final hour; neither party wants to look like the bad guy ahead of the election.

Tech stocks have been leading the market rally and the bounce has been very concentrated (narrowly based). Tech valuations are stretched and we will see if prices can hold after earnings are announced. Microsoft tends to be very stable and the stock has not gone parabolic. I'm expecting a solid number and a muted reaction. Tesla will also report today. After running hard it could be vulnerable to profit-taking.

Swing traders should be almost entirely in cash. Take profits on bullish put spreads and wait for a pullback. The upside reward is much smaller than the downside risk.

Day traders should wait for market support this morning. Late day selling filled the gap yesterday and the bid will be tested this morning. Down opens have been our best day trading scenario and we will identify relative strength early in the day. Once market support is established we will buy these stocks and we will use Option Stalker searches to find them. The high from Tuesday and the low for Monday are likely to hold and we could see compressed trading. We are in a news vacuum and I consider this a low probability trading environment. I have been trading half of my normal size in the morning and 1/4 of my normal size in the afternoon. Fortunately, we will have post-earnings plays to keep us busy during the next few weeks.

Resistance is at SPY $327 and support is at $323.40.

.

.

Daily Bulletin Continues...