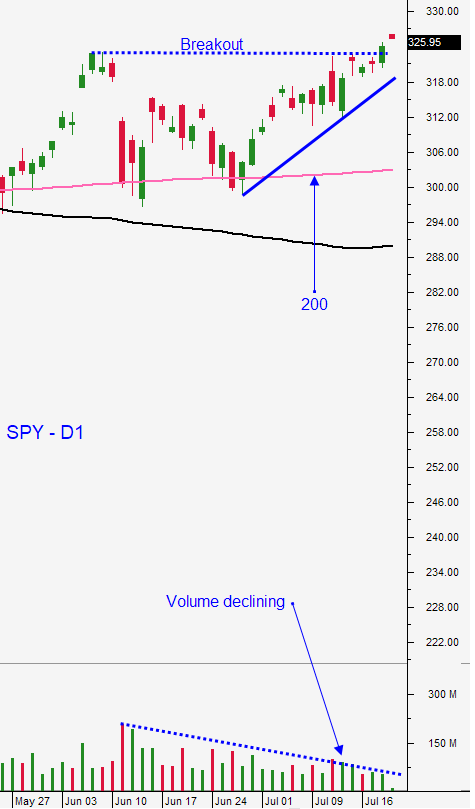

Market Bid Should Be Strong Through July – Take Profits Into Strength – Danger Ahead

Posted 9:30 AM ET - Yesterday the market staged a significant breakout through technical resistance at SPY $323.40 and we are poised to add to those gains this morning. Congress is preparing for the next round of stimulus and analysts believe that it could exceed $1 trillion. This morning the EU approved a stimulus plan for more than $2 trillion. Money is being printed at a record rate and sovereign debt levels are skyrocketing. Look for the market bid to remain strong through July.

The Coronavirus is exposing the "house of cards". The average household can't shoulder a one month layoff from work because they have nothing saved. In an effort to bridge the shutdown, the government dropped money from a helicopter. Now that the virus continues to spread more helicopter drops are needed. I have read that the average baby boomer has less than $10,000 saved for retirement. Unfortunately, extreme debt spans beyond the consumer. Municipalities, states and many corporations are in a similar situation. Sovereign debt levels have also hit record levels and they are guaranteeing each other's currencies through swaps. As long as currencies hold their value, this charade can continue.

This scenario reminds me of an aging adult with health problems. One event triggers another event until drastic measures and life-support are required. The amount of money that has been spent on the virus is mind-boggling and it is a reminder of how fragile our economy is.

We don't pick market tops; we trade what's in front of us. Until we have a technical breakdown below major support we will assume that the market will continue to float higher.

Earnings season will attract buyers and tech stocks are fueling the rally. The bid will remain strong until Apple has reported. In August I'm expecting to see a market pullback.

I have been reading about high-growth bond downgrades, corporations planning to leave major cities (one out of four) and people being kicked out of apartments in the next two months (25 million). I live in the Chicago suburbs and the loss of revenue from summer events (concerts, festivals, sporting events and conventions) will be devastating.

Swing traders need to steadily get to a cash position in the next two weeks. The market rally has been very concentrated and those stocks are overvalued. Some analysts feel that it will take a year for tech stocks to grow into their current valuations. On the other extreme, many stocks are still near their low of the year. They have not budged and the macro backdrop is dismal. I view the upside rewards as being much smaller than the downside risks at this juncture. I needed clarity in May and I have it. The virus took much longer to run its course and consumers are not eager to resume their "normal" lifestyles (which may have changed). When the market drops, it happens very quickly and you should not assume that you will have time to get out of the way. Instead of managing losing positions we will be in cash looking for opportunities.

Day traders should be cautious on the open today. Gaps higher to a new relative high have often been faded and we could see a gap reversal. We need to make sure that the bid is strong. If the opening gap fails right away and we see long red candles closing on their low, favor the short side. If the market establishes support in the first hour and we see a deep drop in the 1OP indicator, we can start to buy stocks with relative strength. The news of more stimulus in the US and in Europe should keep buyers engaged ahead of mega cap tech earnings. On a day trading basis you don't have to worry as much about the bleak backdrop I have painted. Trade what's in front of you and use the 1OP indicator is your guide.

Resistance is at SPY $327 and support is at $323.40.

.

.

Daily Bulletin Continues...