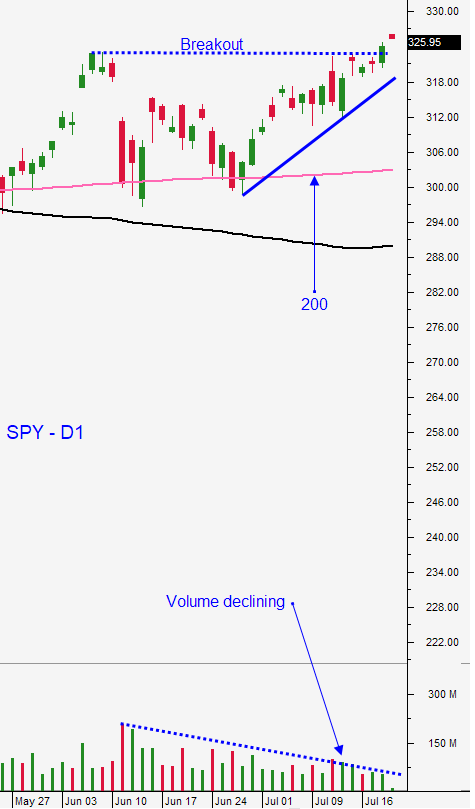

Market Undertow Is Heavy – Swing Traders Go To Cash – Day Traders Get Ready To Short

Posted 9:30 AM ET - Yesterday the market made a new relative high and it looked like we would continue to rally into earnings season. The tone soured quickly and the S&P 500 fell 50 points, closing on its low. The selling pressure was heavy and we are seeing follow-through this morning. I've been warning you for weeks that the upside rewards are smaller than the downside risks and to go to cash. I believe that the selling pressure will build in coming weeks.

Tech earnings typically attract buyers. Netflix, Microsoft and Intel have been the first to report and in each instance they retreated. The market rally has been narrowly defined and tech has led the charge. Many tech stocks are overvalued and they are vulnerable to profit-taking. The majority of the market has lagged behind.

Financials, retail, restaurant, airlines, hotels, industrials, and energy companies employ the vast majority of workers. The PPP is going to run out and businesses will have to lay off workers. The initial $6 trillion stimulus plan has almost been spent and the plan would have worked well if the virus had subsided in May. The "sugar high" would have gotten us through the rough patch, but the virus has been stubborn.

Asset Managers were willing to buy equities knowing that the government had provided a safety net. With interest rates near historic lows, bond yields did not keep pace with inflation (negative real returns) and stocks were attractive on a relative basis. This fueled the market rally.

Economic data points have been positive, but the PPP inflated the rebound in job growth. Without it, unemployment will grow. Yesterday we saw that 1.4 million people filed for unemployment claims and that was higher than the 1.3 million that was expected.

China is the litmus test for the economic recovery and they have a three month head start. Exports only increased by .5%, imports only increased by 2.7% and retail sales only increased by 1.8%. During the recent Dragon Boat Festival attendance was down 49% and revenues were down 69%. This does not reflect pent-up demand and a "V" bottom recovery.

The Coronavirus continues to spread and the states that have retreated to Phase 3 account for 50% of domestic GDP. Many cities are considering a complete shutdown. Politicians are haggling over another $1 trillion stimulus plan and it won't be enough. They did not hesitate in April and they went "full out". There isn't another $6 trillion that they can throw at the problem.

Credit across the spectrum (consumer, municipal, state, federal and corporate) is strained. This is my biggest concern and I sense that a credit crisis is looming. I hope I'm wrong, but I am seeing warning signs.

US relations with China have deteriorated and this is reigniting trade war concerns. The US forced China to close its consulate in Houston and China retaliated by forcing the US to close its consulate in Chengdu.

Three of the major tech companies (Netflix, Microsoft and Netflix) dropped after reporting earnings. Tesla has been a high flyer and it also staged a gap reversal after posting Wednesday. Good news is priced in and profit-taking is starting to settle in. Earnings season is front0-end loaded and that keeps buyers engaged. Apple, Google and Amazon will report next Thursday. I expected to see a decent market bid until those earnings, but recent selling tells me that profit takers are anxious and they won't wait for the news (they want to sell when the bid is still strong).

I've been advising swing traders to go to cash for the last two weeks and I have been pointing to this timeline. Yesterday we had a gap reversal off of a relative high and we are seeing follow-through selling this morning. Swing traders should patiently wait on the sidelines for the next opportunity. We are closing all of our bullish put spreads today. They are far out of the money and they expire today so we can buy them back for pennies. We have one bullish put spread that expires next week (SPCE) and

we can also buy that back for pennies since the spread is $10 out of the money. We've had an incredible run the last six months and it is time to take a breather. The market has been in a 10-year bull rally and I won’t suggest buying puts for swing traders. The market drops have come instantly and so have the bounces. You have to be an extremely nimble trader who is engaged every day (and all day) to take advantage of these moves. Until that long-term trend has changed, I won’t suggest shorting the market to less active traders. Swing traders should be in cash ahead of market declines and they should reenter once support is established. That is how I handle my commentary for swing traders.

Day traders have an opportunity to short this market. I feel that the bid will weaken today and I expect to see selling into the close. Watch for consecutive long red candles that close on their low this morning (five minute bars). Brief bounces that last 20 minutes and fail will be a sign that the market is heading lower. We will use the 1OP indicator to time our entries and exits. If I am completely wrong and the market establishes support, I will trade smaller size on the upside and I will set passive targets. I am much more interested in shorting today. There could be some bearish lottery trades that set up in the last hour.

Support is at SPY $319.50 and $312. If I am short and the market closes on its low today I will hold some of those positions over the weekend.

Swing traders stay in cash. Day traders get short.

.

.

Daily Bulletin Continues...