Market Rally In Final Stages – Go To Cash Before Profit Taking Sets In

Posted 9:30 AM ET - Yesterday the market started the week on a positive note and buyers remain engaged as major tech companies prepared to announce earnings. Republicans released their plan for the next round of stimulus and Democrats will weigh in. Good news is priced into the market and I feel that the upside rewards are much smaller than the downside risks. Swing traders should go to cash while the market bid remains strong – act now. I believe that profit-taking is going to set in perhaps as early as this week.

More than 25% of the S&P 500 has reported and 72% of the companies have exceeded revenue growth expectations and 73% have exceeded earnings expectations. Revenue growth is down 8.3% and net income growth is down 38.5%. These are horrific numbers and it's hard to justify current valuations. Tech giants like Netflix, Microsoft, Intel and Tesla were down after reporting earnings. The S&P 500 is within 100 points of its all-time high and the bounce from the March lows has been very narrowly defined. Only 37% of the NYSE stocks have closed above their 200-day moving average. Ten stocks in the S&P 500 are up 35% since the beginning of the year and the other 490 stocks are down more than 10%. Google, Apple and Amazon are in this group of 10 and they will report Thursday after the close.

From a fundamental perspective the more concerning issue is job growth. Energy, finance, retail, restaurant, hotel, transportation, industrial and automotive companies employ a vast majority of the workforce. Last week initial jobless claims kicked up from 1.3 million to 1.4 million. The PPP created a temporary employment spike and that "sugar high" has been depleted. If there are no changes to the eviction moratorium it is estimated that 23 million people will be forced out of their apartments in October.

Republicans are proposing another round of payments ($1200) to taxpayers and they will reduce the weekly unemployment supplement from $600 down to $500 (not to exceed 70% of salary). The $600 monthly supplement will be reduced to $200 for many people. Republicans feel that the $600 per week is a disincentive to find work. The PPP will be extended to businesses that have lost 50% of the revenue or more ($190 billion). Most analysts feel that this will be a $1 trillion package and it is "baked in". We will see plenty of mudslinging and a deal will be struck at the final hour so that politicians can take their vacations in August.

The Coronavirus continues to spread and states are retreating to Phase 3 or lower. The states account for more than 50% of domestic GDP and this recovery is taking much longer than expected - credit issues are starting to surface. The US dollar has been tanking and gold has been in a steady climb.

Tomorrow we will get the FOMC statement and it should be dovish. It would typically be a focal point this week, but it is a non-event.

Swing traders should be in cash. I feel that profit-taking will set in very soon, perhaps this week. Politicians will get the next stimulus plan approved and they will disappear on recess while the Coronavirus spreads and while the riots continue. Investors will get nervous and they will take profits. I don't advocate shorting this market or selling out of the money bearish call spreads. The snapback rallies have been violent and swing traders need to be fully engaged during the day. My commentary is designed for longer-term positions when it comes to swing trading and the best strategy is to wait patiently for market pullback and then to reload on long positions. This might take a couple of months to play out.

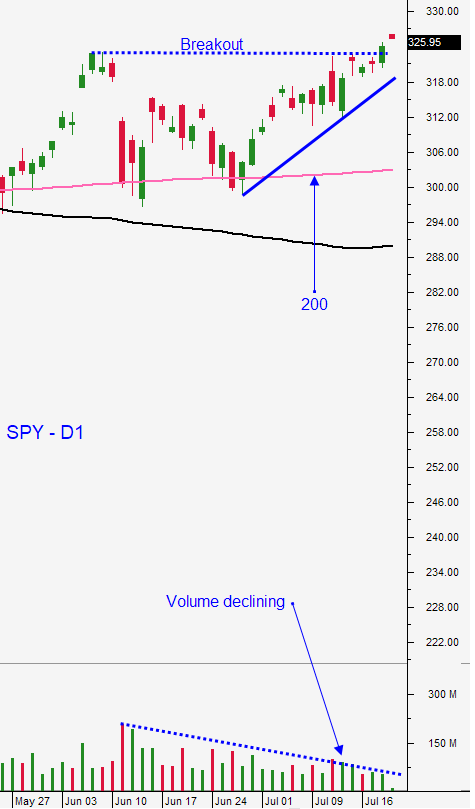

Day traders should watch key technical support levels on a daily basis and they should be ready to short the market when they are breached. I plan to trade the short side when the move finally starts to happen, but I need to see late day selling with follow-through. If major tech companies announced this week and they drop after the number we can expect profit-taking right away. SPY $319, $312 and $304 are key levels to watch. Until then I will trade both sides of the market in small size.

I have been pointing to this timeline for the last two weeks and the virus is taking its toll. I grow more bearish with each passing day.

.

.

Daily Bulletin Continues...