FOMC Statement Today – Big Tech Earnings Thursday – Here’s What To Expect

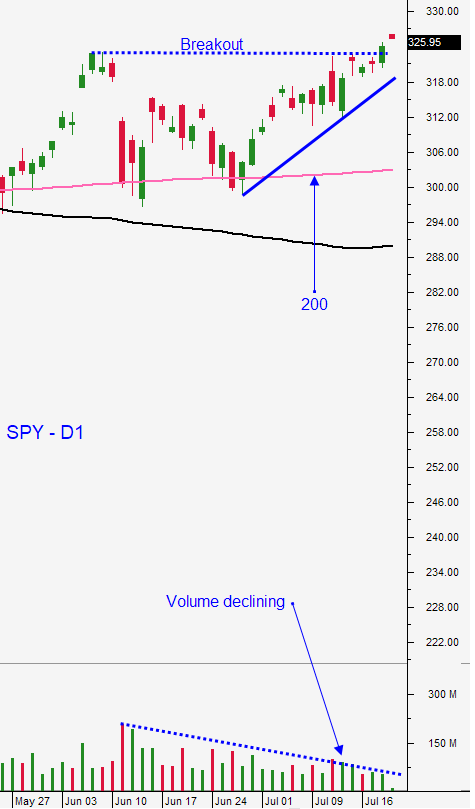

Posted 9:30 AM ET - The S&P 500 has not been able to get through horizontal resistance that was set in early June. Earnings season has not provided the lift that many had hoped for and earnings announcements will climax in the next few days. The spread of Coronavirus is impeding the economic recovery and the next round of stimulus is being negotiated. I believe that the market is due for a correction and swing traders should be in cash.

Tomorrow after the close, Google, Amazon, Apple and Facebook will post earnings. These four stocks account for a huge percentage of the S&P 500 and they belong to an elite group of 10 stocks that have rallied 35% this year. The other 490 stocks in the S&P 500 are down 10% on average this year. This statistic demonstrates how narrowly defined the market rally has been. I believe that once these tech giants announce earnings the selling pressure will increase. Microsoft, Netflix, Intel and Tesla fell after reporting earnings.

More than 25% of the companies in the S&P 500 have reported. Revenue is down 8% on average and earnings are down 35% on average.

The vast majority of jobs are not in tech. They are in restaurants, retail, hotels, banks, industrials, energy and transportation. The Coronavirus is impeding the recovery and the PPP stimulus is running out. That sugar high has run its course and the next tranche is going to be considerably smaller. Last week initial jobless claims increased to 1.4 million (1.3 million expected) and I believe that trend will continue. Workers will not see pent-up demand and they will question their job security. This will impact consumer spending.

Without an eviction moratorium 23 million people could be evicted from their apartments in October. According to research that I've read, 12 million people did not make their rent payment in May. Unfortunately, most Americans have very little saved and they are living “hand to mouth”. Huge bad loan write downs were reported by big banks last week and they are increasing.

As the Coronavirus spreads and the riots continue, Congress will be in recess. Investors will get nervous and we will see a healthy round of profit-taking.

The FOMC statement today should be a non-event. Fed officials know that the situation is dire and their remarks will be extremely dovish.

Swing traders who typically hold positions for two or three weeks and who do not monitor the market intraday should be in cash. The upside reward is much smaller than the downside risk at this stage. Patiently wait on the sidelines for a much better entry point. Instead of managing losing positions, you will evaluate market conditions and you will identify opportunities with a clear head. For those traders who are very nimble, there will be a shorting opportunity.

Day traders should expect choppy price action and low trading volume today and tomorrow. That will change and Friday should be busy. If the tech giants post excellent numbers and the stocks rally, we should see a few more days of support. If they falter, the selling will start immediately. In a best case scenario the market treads water for a few days. Eventually, the economic numbers will spark profit-taking. The intraday action has been choppy and I am trading half of my normal size in the morning at 1/4 of my normal size in the afternoon. I will not hold overnight shorts until I see a technical breakdown in the S&P 500. Before that happens we are likely to see late day selling pressure and follow-through the next morning.

Support is at SPY $319.50 and $312. Resistance is at $323.50 and $327.20.

Look for a few more good days and prepare yourself for profit-taking in August.

.

.

Daily Bulletin Continues...