The Calm Before the Storm – The Market Will Move Based On Earnings After the Close Today

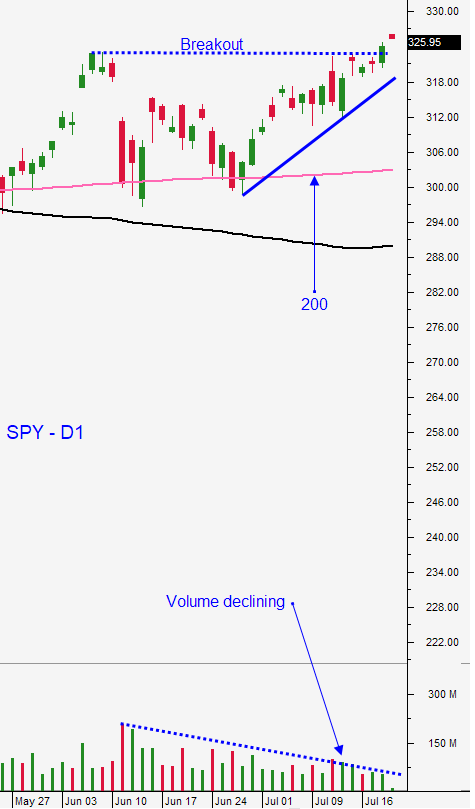

Posted 9:30 AM ET - The market has been trapped in a very tight range during the last two weeks and we are within striking distance of a major horizontal resistance level that was set in June. Apple, Amazon, Google and Facebook will report after the close today and these tech giants will determine market direction for the next few weeks. Major economic releases will also play a major role next week.

I've been pointing out that the rally in the S&P 500 can be attributed to 10 stocks. This is a very narrowly defined market rally and four of these companies will announce after the close. They have benefited from the Coronavirus, but valuations are stretched. Microsoft, Tesla, Netflix and Intel all declined after reporting earnings. The bigger concern is the 490 companies in the S&P 500 that are down an average of 10% this year. These companies employ the majority of the workforce.

This morning Q2 GDP fell 32.9% (-36.5% expected). That is a backwards looking number and I'm more interested in the jobs numbers next week. The PPP stimulus created an artificial employment spike and it will soon run its course. The Coronavirus continues to spread and states are retreating to Phase 3. This will negatively impact consumer spending and it will impede the economic recovery. Workers will worry about their job security and this could start a vicious cycle. This morning initial jobless claims increased to 1.43 million (up120,000 from the prior week).

Republicans and Democrats are miles apart from another round of stimulus according to Mark Meadows and Nancy Pelosi. Politicians will drag their feet until the final hour and they will get a deal done so that they can take their vacations. The virus will spread and the riots will continue. Investors will get nervous when "no one is minding the shop" and August is typically a weak month for the market.

The FOMC statement was as dovish as you can imagine. Jerome Powell said, "The path forward for the economy is extraordinarily uncertain and it will depend in large part on our success in keeping the virus and check." He also said that the Fed has no intention to buy equities.

All of this money printing is weighing on the dollar and it has been in a steady downtrend this month. That has sparked a rally in gold.

Swing traders who can't monitor market during the day should be in cash. The upside reward is much smaller than the downside risk. We need a market pullback so that we can gauge the selling pressure and the strength of the bid. Instead of managing losing positions on a market pullback, we will be evaluating opportunities with a clear head. If the tech companies this evening report fantastic numbers and the market moves higher, the market decline might take another week or two to materialize. Major economic releases (ISM manufacturing, ISM services, official PMI's, ADP and the Unemployment Report) are on deck next week.

Day traders should expect a fairly choppy day today. This is the climax of earnings season and the results after the close today will impact trading for the next week. The market has been trapped in a range and you should expect two-sided price action. Trim your size and your trade count. I have been trading half of my normal size in the morning and 1/4 of my normal size in the afternoon. I have also been setting passive targets. We should see decent volume for the next week. I need to see late day selling and follow through the next day before I can hold short positions overnight. I also need to see technical support breaches.

This is the calm before the storm. Support is at $319.50 and $312. Resistance is at $327.

I will not be publishing market comments on Friday.

.

.

Daily Bulletin Continues...