Train Kept A Rollin – Light Volume Market Rally In A Quiet News Cycle

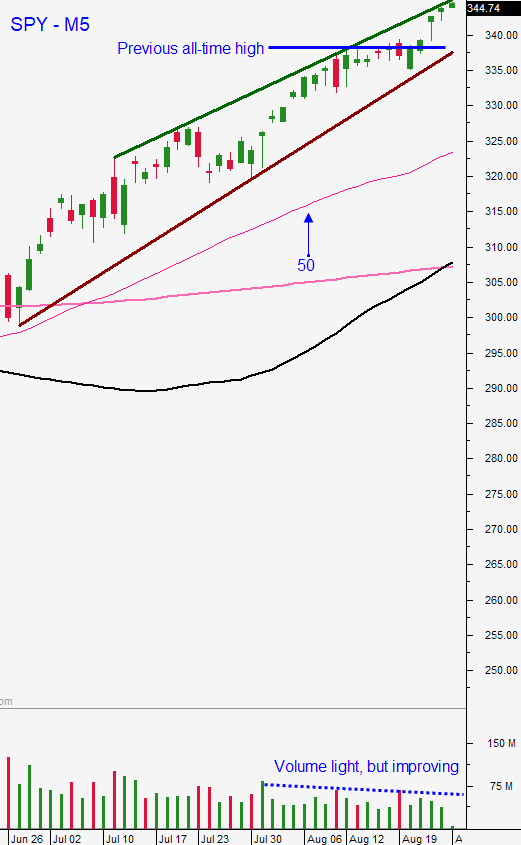

Posted 9:30 AM ET - Yesterday the S&P 500 started flat and the market staged an impressive rally the entire day. The bid was strong stocks closed on their highs. Jerome Powell will speak in Jackson Hole and his remarks should be very dovish. A light news cycle favors the upward momentum.

The second estimate for Q2 GDP came in at -31.7 and that was slightly better-than-expected. Initial jobless claims are still above 1 million and that is problematic. Small businesses are running out of stimulus money and they might have to lay off workers. The second wave of the virus is impeding the economic recovery.

Investors are focused on the decrease in the Coronavirus spread rate and they are optimistic that consumers will resume their normal lifestyles. I'm not as optimistic and I feel that valuations are stretched at a current P/E of 23. Great news is priced in and there is room for disappointment.

I don't see any speed bumps the next two weeks and this breakout to a new all-time high has not attracted profit takers. This is commonly referred to as a seller's boycott (light volume rally) and I sense that we are close to a buying climax. Once we see profit-taking, sell programs will kick in and bullish speculators will be flushed out. The drop will be deep and swift. Until we see a market drop we can't gauge the selling pressure or the buying conviction at lower levels. We need this piece of information.

Longer term swing traders should remain on the sidelines. On a short-term basis we have been selling out of the money bullish put spreads that expire in two weeks and we have six positions on currently. The Labor Day holiday will lead to low trading volumes and I'm expecting tight trading ranges.

Day traders should wait for early support. If the market continues to grind higher, favor stocks with relative strength. It has been very difficult to make money on the short side. Wait for dips and focus on the long side. I am seeing parabolic moves across many big names and stocks are technically overextended. We can't short until the S&P 500 has broken technical support. Watch for late day selling. That would be a warning sign if we get follow through the next day.

I will be taking time off tomorrow and I will not be producing my pre-open-market comments or my daily video.

After Labor Day the volume will improve. This rally is extremely tempting and I suspect that bullish speculators are headed for a trap. Tread cautiously with your swing trades.

.

.

Daily Bulletin Continues...