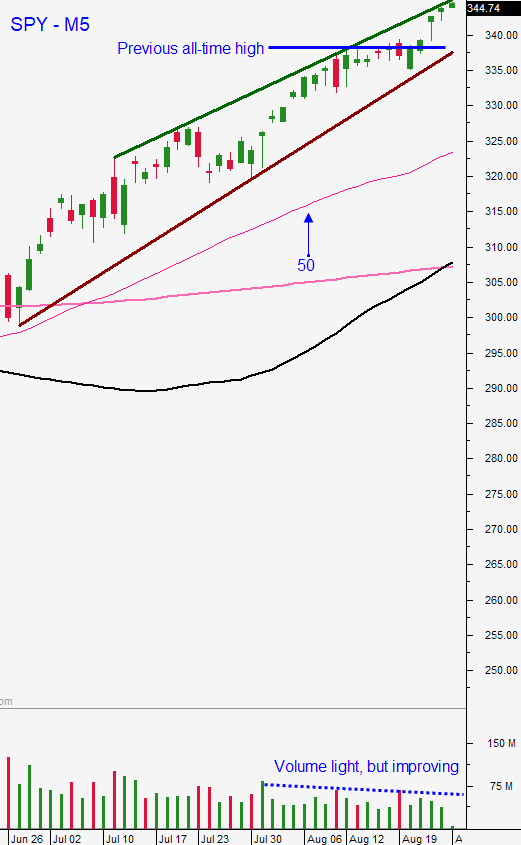

New All-time Market High On Light Volume – Day Traders Wait For the Bid To Be Tested

Posted 9:30 AM ET - The S&P 500 broke out to a new all-time high Monday and there are not any short-term speed bumps to stop the momentum. Trading volume is low and this is a light news cycle. Traders are focused on Jerome Powell's speech in Jackson Hole and it should be dovish. Look for a gradual drift higher.

This morning we learned that durable goods orders increased 11.2% and that was better than the 4.3% that was expected. Ex-transportation, durable goods orders were up 2.4% and that was slightly better than expected. Tomorrow preliminary GDP will be released and the estimate is -32.5. I will be watching initial jobless claims to see if they are above 1 million.

In last week's FOMC minutes we learned that the Fed intends to let inflation rise above the 2% target. This is an extremely dovish stance and Jerome Powell's speech will reflect that tomorrow. The Fed has done all it can and it's time for the government to take the reins (fiscal stimulus). Politicians are in recess and we are not likely to see the $1.5 trillion stimulus plan that the market expected.

Earnings season has ended, but there are a few releases. Toll Brothers, Autodesk, Salesforce.com, Intuit, Urban Outfitters, and Dick's Sporting Goods posted strong numbers. At a forward P/E of 23, the S&P is rich by historical standards.

Swing traders should be in cash the rest of the month. Light volume rallies can quickly be stripped away. I sense that bullish speculation is high and that a buying climax is close at hand. We will sell bullish put spreads on a market pullback and I don’t expect it to last more than a couple of days. If we don't get that opportunity we will have greater clarity in a few weeks and we can join the rally then. I want to see initial jobless claims below 1 million tomorrow. If we start to see improvement it will be a sign that employers are starting to add workers and that Coronavirus fears are not impacting consumption. If the initial claims number rises it will be a sign that employers are laying off workers and that they need the PPP stimulus. The second wave of the virus will impede the economic recovery and I believe the market is ahead of itself.

Day traders should wait for the bid to be established. We saw a late day buying the last two days and that is bullish. The market has opened on its low and closed on its high. That is also a bullish pattern. Once support has been confirmed, buy stocks with relative strength. Set passive targets and expect tight intraday ranges.

Normal trading volume will return in a couple of weeks and that is one I will ramp up my trading.

.

.

Daily Bulletin Continues...