Best August For the Market In 30 Years – Bullish Put Spread Video

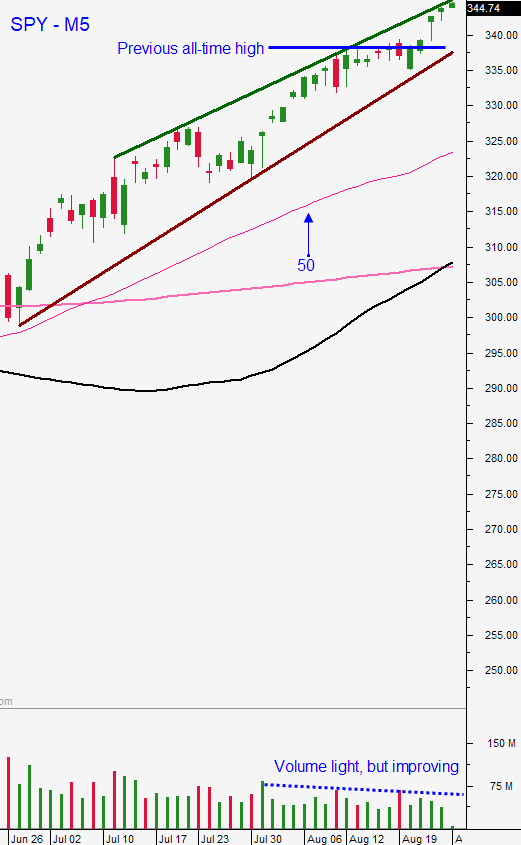

Posted 9:30 AM ET - The market has staged an impressive rally during one of the historically weakest months of the year. This is the best August we've had in more than three decades. Stocks are gradually floating higher on light volume and I categorize this as a seller's boycott. The economic calendar is heavy this week.

China posted its official PMI and it was in line (51.0). Economic activity is expanding, but not at a fast pace. Major Chinese banks have posted a 10% decline in profits year-over-year.

ISM manufacturing, ADP, the Beige Book, ISM services and the Unemployment Report will be posted this week. Initial jobless claims have stayed above 1 million and that could be problematic for the jobs numbers this week.

The eviction moratorium has ended and so has the grace period. This could be an issue for renters in coming weeks.

Republicans and Democrats are unable to reach a stimulus agreement and we are not likely to see any progress before Labor Day. The second wave of the Coronavirus has impeded the economic recovery and small businesses need this life-line.

Jerome Powell's comments in Jackson Hole last week were extremely dovish. The Fed plans to let inflation rise above its target and that means that we won't see tightening through 2021.

Apple will split today and the stock has run up in anticipation of the news. It has been relatively flat the last week and it appears to be hitting resistance.

Swing traders with a longer-term perspective should be on the sidelines. We have been selling out of the money bullish put spreads and we have six short term positions on. We just want a quiet week so that time premium decay can work its magic. Last night I posted a video on YouTube and I highlighted a bullish put spread that should work well. The trading volume should start to improve in the next few weeks and I'm expecting expanded intraday ranges after Labor Day. I still believe that there will be a better entry point for longer-term trades and that we will see a round of profit-taking that flushes out bullish speculators. The dip will allow us to gauge the selling pressure and we can gauge the strength of the bid. I believe the drop will be swift and SPY $337.50 could be tested.

CLICK HERE TO WATCH THE VIDEO WITH THE OPTIONS SWING TRADE

Day traders need to wait for the bid to be tested this morning. Once support has been established the market is likely to float higher. Look for stocks with relative strength and heavy volume. The market has been opening on the low and closing on the high. That is a bullish pattern. End of month/beginning of the month fund buying should keep the upward momentum intact this week. I will be watching for late day weakness. That will be the first warning sign of profit taking.

SPY $337.50 is a key support level and as long as it holds we need to trade from the long side.

.

.

Daily Bulletin Continues...