Market Support Is Forming – It’s Time To Start Using This Options Strategy

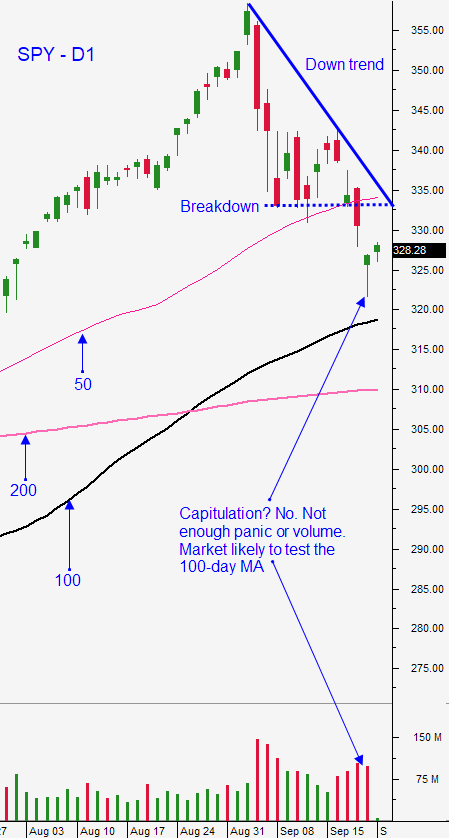

Posted 9:30 AM ET - Yesterday the market was able to close above the low from Friday and we saw late day strength. The S&P 500 is up 12 points before the open and we could challenge resistance at SPY $332. The market bid still very strong and this 11-year rally will die hard. I still believe that there is some downside, but swing traders can start to sell some bullish put spreads.

The big gap down on Monday pushed mega cap tech stocks (AMZN, AAPL, FB, GOOG, MSFT) down to major support levels and they bounced. The market has recovered all of those losses and we are right where we closed Friday. If the SPY closes above $332 we can expect follow-through buying.

Politicians agreed to extend the budget (December 11th) and a government shutdown will be avoided during the election. This was largely expected. The House has approved a stimulus bill, but it won't get through the Senate.

Next week we will get major economic releases. Until then, the news cycle is fairly light.

The Coronavirus is persistent, but people are resuming their normal lifestyles with caution. I've traveled to states with a spike in new cases and I have not noticed any fear. People are wearing masks and my personal observation is that healthy people under the age of 60 are not overly concerned about it. Europe is seeing a spike in new cases and much of the continent is shutting down.

I've been expecting the market pullback and we got one. This move has allowed me to evaluate the selling pressure and the bid. Stocks are rich, but bonds are not an attractive alternative with yields at historic lows. We have not seen persistent selling with follow-through. This three steps down and two steps back decline suggests that support will be formed shortly. I am preparing to sell out of the money bullish put spreads that expire in three weeks or less. I believe that any market decline will find support and that we will have time to adjust positions. By staying short-term with this strategy we also have time decay working in our favor. I will release my Weekly Swing Trading Video tonight and I plan to enter a few spreads.

Day traders can look for opportunities on both sides. I have been seeing better day trading opportunities on the long side. Stick with stocks that have relative strength and heavy volume early in the day (Heavy Buying search in Option Stalker). SPY $332 will be a key level to watch. If we blow through it, trade from the long side. If that resistance is stiff, look for sideways action and a trading range today.

Support is at SPY $329, $36 and $322. Resistance is at $332 and $334.50.

.

.

Daily Bulletin Continues...