Big Market Drop – We Are Dipping Our Toe In the Water – Use This Options Trading Strategy

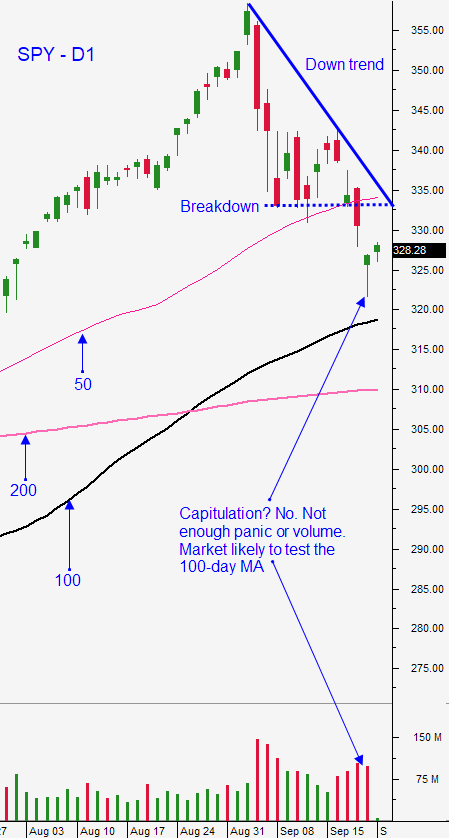

Posted 9:30 AM ET - Yesterday profit-taking resurfaced and the S&P 500 dropped to its low from Monday. The selling pressure was heavy and we are likely to see more downside today. In the next week I expect to see the S&P 500 down to the 100-day moving average and that is likely to happen today.

From a technical perspective, the S&P 500 has formed a downward sloping trading channel from its high. This pattern is typically resolved with a breach of the lower end of the trading channel and that could take us down to the 200-day moving average. This process is three steps down and two steps back. Buyers are still engaged and the initial stages of a correction are very stubborn after a strong rally.

Jerome Powell has been testifying before Congress and his remarks have been extremely dovish. Fed officials agree that they've done all they can and that it's time for fiscal stimulus. Unfortunately, a stimulus bill is unlikely before the election. The Fed will not raise rates in the next two years and they are willing to let the inflation rate rise above their target.

The Coronavirus continues to plague the economy and there are new "hot spots" each day. Europe has seen a spike and much of the continent is shutting down. Based on my own observations, healthy people under the age of 60 are resuming their normal lifestyles. They are wearing masks and avoiding crowds when possible and they are not nearly as fearful as they were five months ago. I believe that this bodes well for a steady economic recovery, but we won't be off to the races.

Goldman Sachs has lowered their projection for Q3 growth to 3% (previously 6%). The second wave of the Coronavirus has hampered the economic recovery.

Stocks are rich by historical standards (current P/E of 22) and there is room for disappointment. The travel and entertainment industries will be hit the hardest. According to analysts 60% of the restaurants will never reopen and they employ 8% of the work force.

The death of Ruth Bader Ginsburg could create election uncertainty. We won't know the election results for at least a week as mail-in ballots are counted. If there are only eight Supreme Court justices we could have a 4 to 4 split if they have to determine a winner. This would lead to chaos and the market hates uncertainty.

Interest rates are at 0% and yields don't keep pace with inflation. The only chance for a reasonable rate of return is in equities and that will keep a bid to the market. Many companies are borrowing at ridiculously low rates and they're using the proceeds to repurchase shares of stock. This will keep an underlying bid to the market and it's why we won't see a waterfall selloff like we had in March. A sustained market decline will only happen if credit concerns start to surface and I don't see that happening anytime soon.

Swing traders who can't watch the market intraday should prepare to sell out of the money bullish put spreads on the next big decline. In last night's Weekly Swing Trading Video I highlighted three stocks that want to move higher. The market decline during the last two weeks has revealed the "real McCoy's". Buyers are lined up to buy the shares and they have not been deterred by downward market pressure. Eventually, these stocks will temporarily dip and that will leave us with an opportunity to sell out of the money bullish put spreads below major technical support levels. As the market drops, option implied volatility will spike and we will be nicely rewarded for selling premium on stocks with relative strength. When the market decline pauses, these stocks will bounce. This strategy takes advantage of time decay and we are trying to sell premium inside of a three week window. We need the market selloff to get the credit we want. Once market support has been established we will get more aggressive with our bullish put spreads. Instead of waiting for the stocks to come in, we will start banging out the spreads at their current prices when technical support has been confirmed. We are just starting to dip our toe into the water. I believe that the 100-day moving average will be tested with ease today and I also believe that the 200-day moving average is in play. That's where I expect to see firm support and I don't believe we will spend a lot of time at that level.

Day traders should look for opportunities on the short side. We have a technical breakdown and strong momentum. If the market drop is over-extended we will see multiple attempts to breach the low and the market will bounce once the bid is confirmed. It's clear that sellers have the upper hand. Buyers will be relatively passive until they see support. As long as the downward sloping trend line on the S&P 500 is intact (daily chart) you have to short into bounces and take profits on the drops. This will be a stair-step process that eventually climaxes with a couple of long red bars and a bullish hammer that marks the capitulation low. We have been able to find excellent trading opportunities on both sides of the market in the last few weeks. Continue to focus on relative strength/relative weakness and use the 1OP indicator as your guide. If the market makes a new low after two hours of trading we are likely to see a bearish trend day. This could get ugly today.

Support is at SPY $319.65 and $310. Resistance is at $322, $328 and $332.

.

.

Daily Bulletin Continues...