Market Still Has More Downside – Watch For This Pattern Today

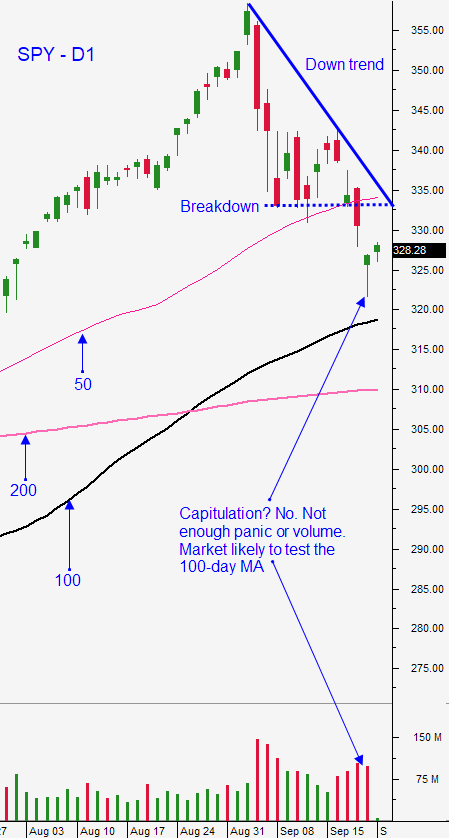

Posted 9:30 AM ET - Yesterday the S&P 500 gapped 55 points lower on the open and it was able to hold the low of the day. Buyers nibbled and stocks rallied in the afternoon. This pattern made it seem like a victory for bulls, but the technical damage was clear. The S&P 500 closed well below its 50-day moving average and the 100-day moving average is within striking distance. I expect to see more selling in the next week.

There wasn't any incremental news overnight and the S&P 500 is flat before the open. The big drop yesterday was over-extended. If the market had opened flat on Monday morning and if it closed where it did, the tone would’ve been much more bearish. We saw a similar pattern last Thursday and a big gap lower found support throughout the day. A small bounce into the close left bulls feeling optimistic, but the selling pressure returned on Friday. Today we will see if that pattern repeats.

Tech stocks performed well and Amazon, Apple, Google, FB and Microsoft all bounced off of major moving averages. These stocks comprise 25% of the S&P 500's market cap.

A fiscal stimulus bill looks unlikely before the election and small businesses need the lifeline. The death of Ruth Bader Ginsburg could be important if the Supreme Court has to determine who won the election. With mail-in ballots we can expect a delay and the winner will not be determined the day after the election. The market hates uncertainty and this is a dark cloud.

Many parts of Europe are shutting down due to the Coronavirus and that will hamper global economic growth. Conditions in the US are improving, but many parts of the country are still in Phase 3.

Stocks are priced for a big economic rebound and that is overly optimistic. At a current P/E of 22, the S&P 500 is rich and there is room for disappointment.

I believe that we will see a gradual market decline to the 100-day moving average. In the initial stages the bid will be relatively strong as under-allocated Asset Managers who missed the summer rally play catch-up. As the selling pressure becomes more pronounced buyers will pull bids and the market decline will accelerate. Ultimately, support will be formed and a buying opportunity will present itself. We are in an 11-year bull market rally and we are in a five-month bull market rally. It is very difficult to make money on the short side and this should only be attempted by day traders. Swing traders who can't watch the market during the day should be in cash waiting for the buying opportunity I've outlined.

Day traders should look for an opportunity to short early today. The market won't rally until the downside has been tested. Yesterday felt like a victory for bulls, but the market still closed down on the day. Given the flat open this morning, I believe that we will see a steady decline if the market makes a new low for the day after the first hour of trading. This type of move gains momentum throughout the day and I will be gauging the selling pressure. If the market can't stage a decent bounce throughout the course of the day it will be a sign that the 100-day moving average will be challenged in the next week. The low from Friday was SPY $327.97 and I'm expecting that resistance to hold. If we rally above it, the market will try to rally to SPY $330.60. During this tug-of-war we are finding excellent opportunities on both sides of the market. Stay flexible and use the 1OP indicator and the Option Stalker searches as your guide.

I will focus on the short side early in the day and I will watch the levels I have outlined above. A very gradual and very steady drift lower without any major bounces would be a very bearish sign and I believe this is the pattern that will prevail today.

.

.

Daily Bulletin Continues...