Market Still Has To Find Support – Start Using This Options Trading Strategy On Dips

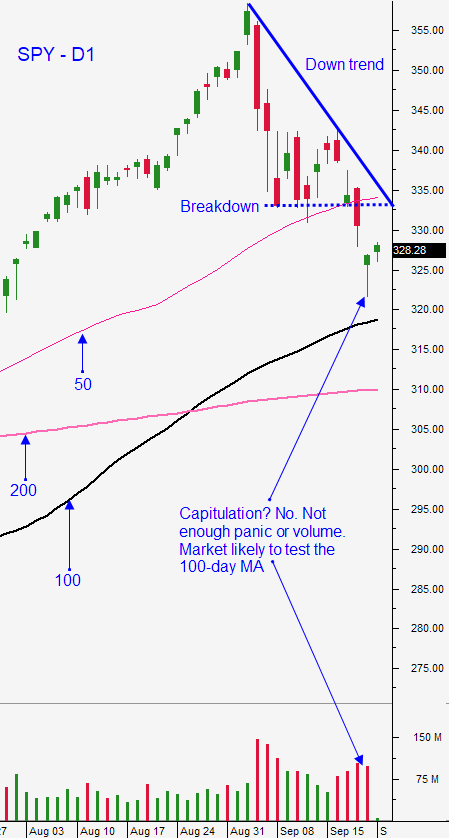

Posted 9:30 AM ET - Yesterday the S&P 500 briefly tested the 100-day moving average and it rallied off of that level. Sellers gradually returned in the afternoon and the buying dried up. We are likely to test the 100-day moving average again today.

There wasn't any incremental overnight news. Politicians are trying to negotiate a stimulus bill and Steve Mnuchin said that he's met with Nancy Pelosi 15 to 20 times in the last few days. That is encouraging, but I'm not holding my breath. The chances for a stimulus deal have increased slightly.

Negotiations also seem to be improving on a Brexit deal.

Coronavirus cases are increasing and the testing has increased. Europe has also seen a spike in new cases. In general, fear of the virus has decreased in the last few months and from my own personal observations, people have adjusted.

Economic forecasts have been lowered and Q4 GDP is expected to grow at 2.5% and Q1 2021 GDP is expected to grow at a 2% rate. Durable goods orders decreased .4% (1.5% increase expected) and initial jobless claims remain elevated (840,000). The second wave of the Coronavirus is impacting growth.

Stock valuations are stretched at a P/E of 22 and there is room for profit taking.

Bond yields are at historic lows and they will remain that way for at least two years. This makes equities relatively attractive and Asset Managers are willing to ride out this soft patch.

Swing traders can start to nibble. During market declines find stocks with relative strength and sell out of the money bullish put spreads on stocks with relative strength. Stay inside of a three week window to take advantage of time decay. Option implied volatilities will remain fairly high during this market selloff so you can distance yourself from the action. Lean on major technical support levels and sell the spreads below those price points. It's not time to get aggressive. We need to establish firm support and it needs to be tested (confirmed). Once we have that technical pattern we will be able to get much more aggressive with our bullish trades. It's very possible that the SPY tests the 200-day moving average before ultimately finding support.

Day traders should go with the flow. We are seeing nice ranges and steady intraday directional moves. Ride the momentum until it stalls and look for opportunities to trade reversals. There is a general downward bias, but this is a stair-step decline (three steps lower, two steps up). In the absence of a stimulus bill I believe that we could close on the 100-day moving average today. I would not want to carry any shorts over the weekend because there is a chance that politicians actually do their jobs (reach a stimulus bill agreement). The 1OP indicator is our guide and it will tell us when to be long or short. Use Option Stalker searches to find the best stocks and draw alert lines when you see tight trends. We will be looking for option lottery trades late in the day.

Support is at 100-day moving average and resistance is at $327. I'm expecting that range to hold today.

.

.

Daily Bulletin Continues...