Market Bid Is Starting To Grow – Watch This Critical Price Level

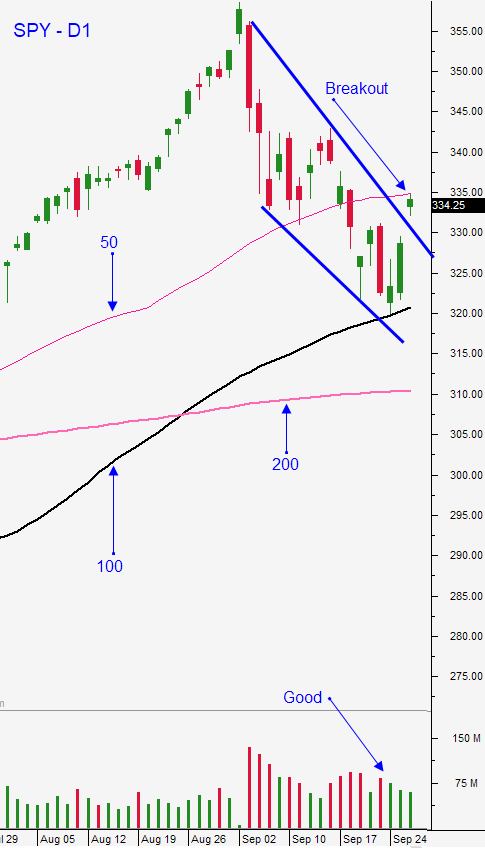

Posted 9:30 AM ET - Yesterday the market gapped higher on optimism that a stimulus bill would be approved. The S&P 500 challenged the 50-day moving average and the downward sloping trend line that started in August. This is a small resistance area and a close above it would be bullish.

We have not seen a capitulation low and I doubt that we will. There is not enough damaging news to spark panic selling and I believe this is just a normal wave of profit-taking. Traders can start passively selling out of the money bullish put spreads on stocks with relative strength. I won't get more aggressive with long positions until I see support tested again. Ideally, the market makes a higher low and it bounces above the 100-day moving average during the next dip. This type of price action would confirm that support and it would attract buyers.

The news front is relatively quiet today. ISM manufacturing, ADP and the Unemployment Report will be released this week along with official PMI's. The news should be good, but not as robust as many had hoped. Consumer confidence will be released 30 minutes after the open.

Politicians are trying to negotiate a stimulus bill and both sides confirmed that new meetings are planned. Republicans are looking for $1.5 trillion and Democrats are looking for $2.2 trillion. Tonight President Trump and Vice President Biden will hold their first debate.

Swing traders should try to enter out of the money bullish put spreads that expire in three weeks or less. Focus on stocks with relative strength that have firm support levels. Sell the spreads below technical support and let time decay work its magic. If the stock breaks technical support or if the SPY closes below the 100-day moving average, buy the spreads back. I'm not expecting a big market decline, but we could see the low from last week tested. If that happens and we bounce off of that support I will get more aggressive with my longs. Buyers are starting to gain confidence.

Day traders should watch for two-sided action. If the SPY rallies above the high from yesterday on the first attempt, it will continue to grind higher. I have been finding better candidates on the long side and I believe that tech is poised to bounce. The action this morning is relatively flat. Let the early chop play out and wait for a directional move. The 1OP indicator has been spot on. I'm expecting better price movement today and we should have good opportunities. My favorite Option Stalker searches on the open are Heavy Buying and PopBull. If the market declines I add Relative Strength 30 to the mix. As the morning progresses I include BullRun in my routine. Keep flipping charts and look for heavy volume and relative strength. When you find it, wait for a bullish 1OP cross. This is our standard operating procedure and it's been working great.

Support is at SPY $332 and resistance is at the 50-day moving average.

.

.

Daily Bulletin Continues...