Wait For Market Support – Then Sell Out of the Money Bullish Put Spreads

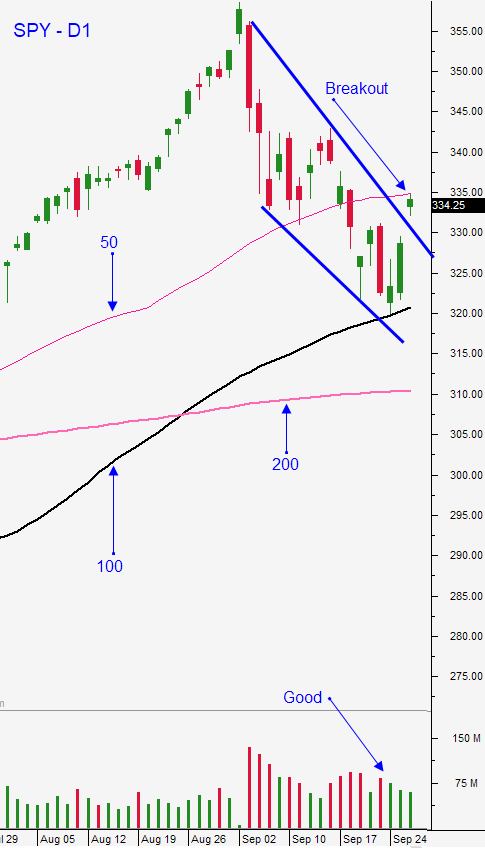

Posted 9:30 AM ET - The S&P 500 bounced off of the 100-day moving average last week. Since then it has broken the downtrend line started in August and it has closed above the 50-day moving average. Buyers are engaged and I believe that the next round of selling will produce a higher low and it will confirm technical support. President Trump tested positive for the Coronavirus and the S&P 500 is down 45 points before the open. This drop will reveal the appetite for stocks.

President Trump plans to run the country while he is quarantined. He says he feels fine and Vice President Pence is ready to take the reins if needed. I believe that this news would've shocked investors a few months ago, but we know more about the virus now and the fear level is subsiding. He has been steadfast in his efforts to reopen the country and he has been undeterred by the risks of personally contracting the virus. His health could impact future presidential debates and we are only one month from the election.

Personally, I feel that he is in relatively good health and he will get the best care available. A speedy recovery would instill confidence and it could boost economic activity. Almost half of the deaths have been from elderly people that have health complications.

The stimulus bill is in limbo. Democrats want more money for states/municipalities and Republicans want more money for small businesses. Republicans also want to limit small business liability related to the virus. Daily meetings are taking place and the market is reacting to every word. If not nor President Trump contracting the virus, the market would chop around today while it waits for stimulus news.

The second wave of the Coronavirus has hampered economic growth. This morning we learned that 661,000 new jobs were created in the month of September and that is lower than the 850,000 jobs that were expected. Initial jobless claims have been hovering around 850,000 each week and that was a sign that this number could be soft. ISM manufacturing was also a little light yesterday. The other data points have been good. ADP was better-than-expected and consumer confidence came in at a robust 101.8.

I believe that this knee-jerk sell-off will set up a buying opportunity above the low from last week. Swing traders should take this opportunity to sell out of the money bullish put spreads on stocks with relative strength. In particular, I like stocks that have broken through horizontal resistance on heavy volume recently. Sell the bullish put spreads below technical support. As long as the market stays above the 100-day moving average and the stock stays above technical support, hang on to the position. I would also sell bullish put spreads that expire in less than three weeks. This will allow you to capture accelerated time decay and you will be able to constantly evaluate positions and the market. I don't plan to hold many positions over the election.

Day traders should watch support at SPY $332. If that fails we are likely to test $329 and fill the gap that was created Monday. The rally this week was caused by optimism that a stimulus bill would be signed. As long as the meetings continue, buyers will be engaged. I will be looking for opportunities to get long today. I believe that this market drop is an over-reaction to President Trump contracting the Coronavirus. Once support is established I will be looking for opportunities to buy stocks with relative strength. I will also be selling out of the money bullish put spreads. If the market makes a new low after two hours of trading it will be a sign that we will trend lower the entire day. I'm not expecting this, but this type of price action would temper my bullishness today. I have been finding better opportunities on the long side and that tells me that the bid is strong.

Support is at SPY $322, $329 and $332. Resistance is at $335.50 and $338.70.

.

.

Daily Bulletin Continues...