How Long Will It Take To Determine the Next President? The Answer Will Impact the Market

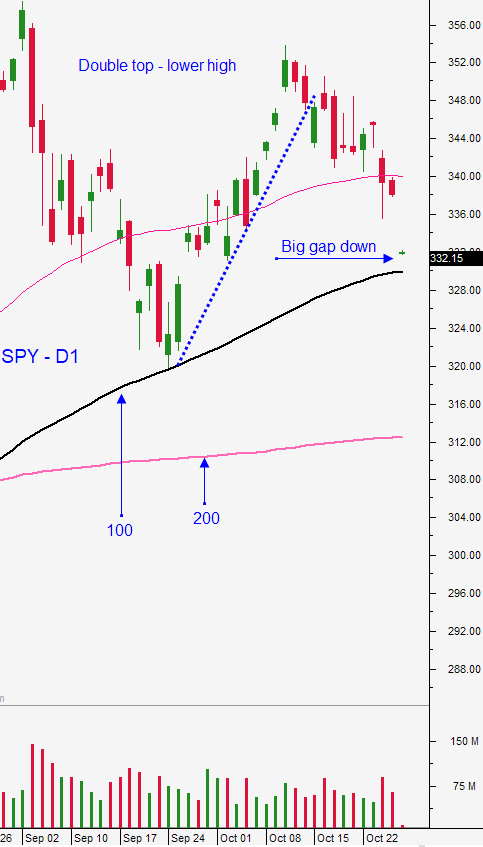

Posted 9:00 AM ET - Last week the market had nervous jitters ahead of the election and the S&P 500 closed below the 100-day moving average. New Coronavirus cases are spiking domestically and internationally and election results might not be known for weeks. These two issues will weigh on the market and a buying opportunity will surface when we have election clarity.

Much of Europe is in a complete shutdown and many states in the US are considering similar as the number of new cases spikes. This will impede the economic recovery and the Q3 earnings are expected to decline 20% on average. Small businesses need the stimulus bill and any delay in the election results will also postpone this lifeline. Both parties want the stimulus bill.

The economic data points have been decent and China's PMI came in at 51.4. Domestic economic releases this week include ISM manufacturing, ISM services, ADP and the Unemployment Report. GDP is backwards looking, but it came in at a robust 33.1%.

All eyes are focused on the election. Mail-in voting has increased dramatically and these ballots will take time to process. In close races the results will be contested.

If the election results are known this week, I believe the market will rally. If the outcome is delayed for weeks, we are likely to see civil unrest and the market could test the 200-day moving average.

This is a binary event and it could go either way. Swing traders should stay in cash and wait for clarity.

Day traders should expect wide intraday ranges and nice intraday opportunities. This morning we are seeing beginning-of-the-month fund buying and the S&P 500 is up 35 points before the open. If this bounce is going to reverse it will happen in the first hour. Expect two-sided action this week.

Support is at $320 and $312. Resistance is at $333 and $337.50.

.

.

Daily Bulletin Continues...