Election Day – Let’s Hope For A Decisive Victory

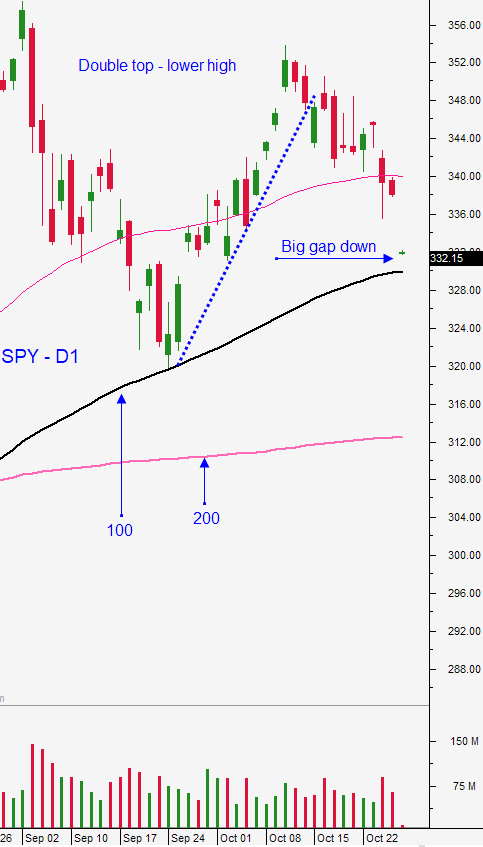

Posted 9:30 AM ET - Yesterday the market rallied above the 100-day moving average and it was able to hold that support. The S&P 500 is up 35 points before the open and traders are expecting definitive election results in the next day or two. Both parties want a stimulus bill and a quick election result will speed up fiscal spending and reduce the chances of civil unrest.

Mail-in ballots could slow down the process in key battleground states. On average, the market has rallied 6% after the election 15 of the last 17 times.

Earnings season is unfolding and the results have been in-line. At a P/E of 23, valuations are rich.

Major economic releases this week include ISM services, ADP and the Unemployment Report. We also have the FOMC statement Thursday, but with 0% interest rates the market already expects the Fed to be dovish.

Swing traders should remain sidelined. We will wait for the election results and then we will trade accordingly.

Day traders should expect choppy trading today with wide price swings. Yesterday the opening gap was filled and the market finished inside of the first hour range. This is the type price action we can expect today.

My market comments are light because we are on the brink of a binary event. Prices could go higher or lower and we need to wait for the election outcome.

Support is at $330.70 and resistance is at $335.60 and $339.

Go vote!

.

.

Daily Bulletin Continues...