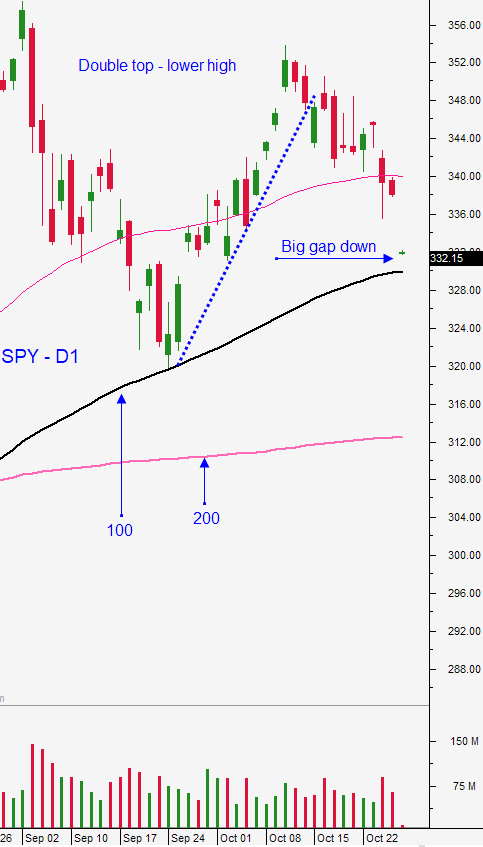

Big Tech Earnings Reaction Soft – Market Will Drop Into the Election

Posted 9:30 AM ET - Yesterday the market tried to rebound and the S&P 500 closed right at the 100-day moving average ahead of major earnings announcements. The tech giants posted excellent numbers, but these stocks retreated after posting results. Those earnings releases were keeping a bid to the market and now there is nothing to keep it afloat before the election. I believe that we will see additional selling the next few days and we could test the 200-day moving average if election results are not known by the end of next week.

Sellers are historically passive ahead of mega cap tech earnings because these companies have been fueling the market rally. Amazon, Apple, Facebook, Google, Microsoft and Twitter comprise 57% of the NASDAQ 100. With the exception of Google (small gain), all of these stocks are trading lower. At a P/E of 23, stocks are rich. In general, Q3 profits are expected to decline 20% year-over-year. The recovery in Q4 will be hampered by the resurgence of the Coronavirus.

Buyers were hopeful the politicians would pass a stimulus bill before the election. That's not going to happen and that safety net is gone.

Mail-in ballot procedures vary state-by-state and if the election results in battleground states are close, we can expect a recount. State voting officials have already said that they expect the results to be contested. Unless there is a landslide victory (unlikely) this process could take weeks. Civil unrest is possible in the market hates uncertainty. On average, the market has rallied 6% after the election in 15 of the last 17 elections. One of those exceptions was in the year 2000 (Bush/Gore) when the results were not known for many weeks. In terms of policy, I can't remember a bigger disparity and the country is deeply divided. A drawn out recount would also delay a much needed stimulus bill.

The economic numbers have been decent. Preliminary Q3 GDP was up 33%. Some of that was due to the reopening of the economy early this summer. Conditions are deteriorating as the Coronavirus spreads and many states are in Phase 3. This will have a negative impact on Q4 earnings.

Swing traders should stay in cash. The farther we fall the better the buying opportunity. We are going to wait on the sidelines for clarity. The market is in an 11-year bull rally and I do not want to short overnight. The snap back rallies are violent. Historically low interest rates will keep buyers engaged and a vaccine will be available in the next two months. Be patient.

Day traders should prepare for additional selling pressure. The S&P 500 is down 30 points after tech earnings yesterday. Asset Managers are reducing risk and the 100-day moving average has been breached. I expect to see a nervous market heading into the weekend. Use the 1OP indicator as your guide and lean on Option Stalker searches. Shorting is a bit more difficult than buying because the price action is choppy. Long red candles are followed by mini bounces. Take profits on those long red candles and reload on the mini bounces.

Support is at SPY $325 and $320. Resistance is at the 100-day moving average.

.

.

Daily Bulletin Continues...