Market Got Ahead of Itself – Bulls Need This To Happen Soon

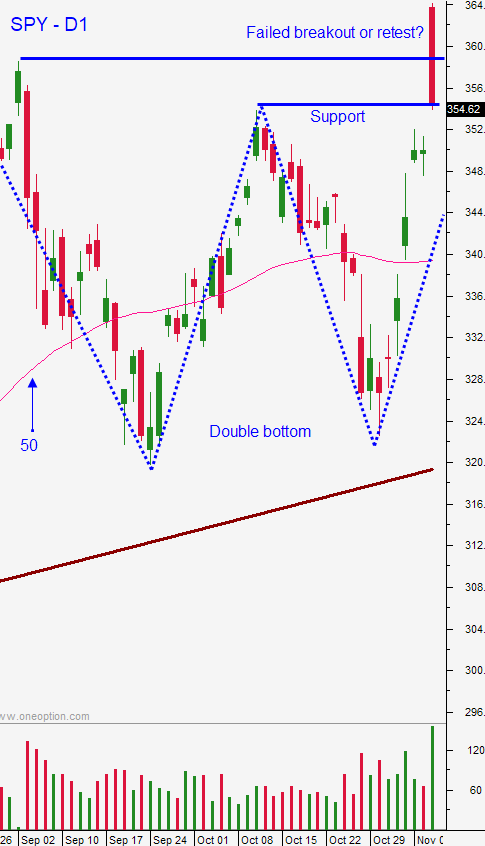

Posted 9:30 AM ET - Yesterday the S&P 500 surged 150 points to a new record high on the opening bell. Optimism over a Coronavirus vaccine sparked buying on the notion that the economy will be able to get back on track in 2021. Stocks spent the entire day retreating and most of the gains were given back. The S&P 500 is below the prior all-time high and traders are wondering if this was a buying climax.

From a technical perspective it's not unusual for the market to retrace and to test the breakout before advancing. Bulls want to see a bounce this week that rallies back above the all-time high. If the market is not able to do that, this could be a buying climax.

The market rally from last week assumed that Republicans would retain control of the Senate. That is now in question since there are two runoffs in January. If Democrats win both races there will be a 50/50 split and the vice president will cast the winning vote. The market wants Republicans to retain the Senate so that the Trump tax cuts are preserved.

Politicians will be negotiating the budget to avoid a government shutdown in the next few weeks. They will address the stimulus bill at the same time. The market wants a $2 trillion stimulus bill now.

President Trump is contesting the election results and the counting process in key states. He has the right to do this and the Supreme Court could get involved.

England could be facing a hard exit from the European Union and the November 15th deadline is approaching quickly. The negotiations have been very strained and this could be another speed bump for the market.

Earnings season is winding down and the results have been good. Valuations are still lofty at a P/E of 23. Tech stocks were hit hard yesterday as investors rotated out of that sector and into cyclicals. They will come under pressure again today as antitrust legislation is being considered in the US and abroad. Travel and hospitality stocks surged yesterday and the vaccine news is encouraging for these companies.

Swing traders should be looking for opportunities to sell out of the money bullish put spreads. We are long the SPY and we will use a closing stop of $350 (check five minutes before the close). We want to give the SPY room to move around during the day, but we wanted to close above $350. Traders are expecting and economic rebound in a couple of months when the vaccine is widely distributed. Pfizer will have 50 million doses available this year. Moderna and AstraZeneca will start distributing their vaccines in the next two months as well. Once the economy gets back on its feet, pent-up demand will drive profits. I will be looking for opportunities to sell bullish put spreads in sectors where consumer demand will start to recover. If the market rallies back above SPY $360 this week we can get more aggressive with our bullish put spreads. If the market is not able to get back above that price point, we have to be a little more cautious.

Day traders should let the early selling run its course. Once support is established, I believe the market will start to grind higher. Big rallies to a new relative high have reversed this year and we've seen buyers return the next day. We will see if this pattern repeats today. Use the 1OP indicator on a five minute basis as your guide for the S&P 500. When the indicator is bullish, buy stocks with relative strength and heavy volume. We should see nice intraday ranges and lots of trading opportunities.

Support is at SPY $352 and $347.50. Resistance is at $358.75 and $364.40.

.

.

Daily Bulletin Continues...