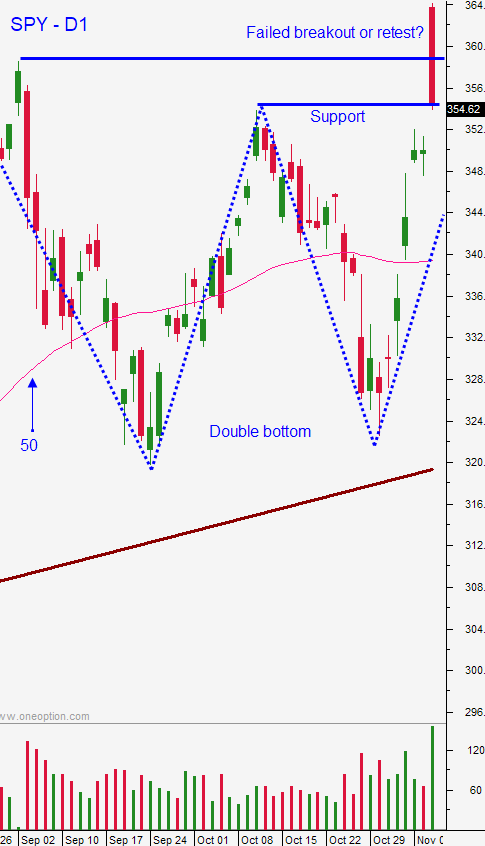

The Market Tested the Breakout – Stay Long!

Posted 9:30 AM ET - Yesterday the S&P 500 took a pause after a monster breakout on Monday. News that Pfizer will start distributing its highly effective vaccine before year-end sparked a 150 point rally to start the week. Those gains gradually disappeared during the day and yesterday the market filled that opening gap from Monday. The breakout has been tested and a close above SPY $360 this week would be very bullish.

There was a massive rotation out of tech and into laggards. Travel, entertainment, restaurants, casinos and hotels rallied on the news Monday. To this point, most of the bounces in these stocks have failed. This move should have staying power and many biotech companies have new vaccines and treatments that will be available in the next month or two. I believe that this could be the beginning of a broad based rally. The market gains this year have been narrowly confined to the tech sector and this should be a much higher quality rally (broad-based).

The number of Coronavirus cases is escalating globally and we are not out of the woods yet. Asset Managers see the light at the end of the tunnel and they will start buying stocks now.

The economic releases have been good and ISM manufacturing, ISM services and the Unemployment Report were all very solid last week.

Earnings season is winding down and profits are substantially lower year-over-year. The virus will weigh on Q4 earnings as well and stocks are expensive by historical measures (P/E of 23). This means that monster rallies like we saw Monday are vulnerable to profit-taking. Once the economy is back on its feet and the virus is under control, profits will grow very quickly.

The market is pricing in a Biden victory, a Democrat controlled House and a Republican controlled Senate. The election results are being contested and if there is evidence of fraud the market will adjust at that time. Polls suggest that Republicans should when the Senate seats in the Georgia runoff. If that changes, the market will react negatively because it wants the Trump tax cuts to remain intact. I'm not making any political statements; I am reflecting what is priced into the market.

Republicans and Democrats want a stimulus bill and it is likely to be negotiated along with the budget/debt ceiling. This needs to be addressed immediately to avoid a government shutdown in December. Small businesses need the stimulus lifeline and the market is expecting a $2 trillion bill this year.

Swing traders are long SPY at $350 from the opening last Friday. Use a stop (closing basis) of $350. Swing traders should also be selling out of the money bullish put spreads on stocks with relative strength that have broken through resistance. Sell bullish put spreads that expire in 3 weeks or less below technical support and take advantage of accelerated time premium decay. Option Stalker finds the best stocks. In particular I like stocks that have relative strength, heavy volume and technical breakouts after posting earnings. This evening I will post my Weekly Swing Trading Video and I will have four new trades. If the market can grind higher this week I believe the technical breakout will hold and the quality of this rally will be excellent. I'm not looking for a monstrous move, just a nice steady move higher. Valuations are still a little rich and profits will catch up in time.

Day traders should look for opportunities to get long. If the market is able to make a new high after 90 minutes of trading I will get more aggressive with my long positions. Stocks will open above the high from Tuesday and we want to see that support hold. Heavy Buying, After Earnings Bull and PopBull are my favorite searches right out of the gate. After 30 minutes of trading I also start looking at Bull Run. If the market dips after the open I will rely on Relative Strength 30. Our routine in the chat room produces consistent day trading results regardless of market conditions. Today I would focus on the long side if the early gains are preserved after 45 minutes.

Support is at SPY $351 and $355. Resistance is at $358.75 and the all-time high.

HAPPY VETERAN'S DAY. I WOULD LIKE TO THANK ALL OF THE COURAGEOUS MEN AND WOMEN WHO HAVE PROUDLY SERVED OUR GREAT NATION.

.

.

Daily Bulletin Continues...