Good Vaccine News Is Spreading As Fast As the Virus – Watch For Profit Taking

Posted 9:30 AM ET - One week ago the S&P 500 spiked 150 points overnight on positive vaccine news. It immediately gave back those gains and it spent the rest of the week trying to recover. This morning we have additional good news on a new vaccine from Moderna and the S&P 500 is up 35 points. It looks poised to challenge the high from last Monday and investors are looking past the current increase in new Coronavirus cases. At a current P/E of 40, stocks are rich and we can expect profit-taking when the market gets overextended.

Moderna said that its vaccine had an efficacy rate of 94.5% and that is even higher than Pfizer's results a week ago. AstraZeneca is also in the late stages of Phase 3 clinical trials and they are mass-producing their vaccine for immediate distribution upon FDA approval. Last week, Eli Lilly got approval for a drug that greatly reduces the need for hospitalization for those who have been infected. The good news on the vaccine front is spreading almost as fast as the virus itself.

States are considering a complete shutdown in an effort to tame the spread of the virus. This is the busiest time of year for consumers and shut downs will weigh on economic activity in Q4.

Economic data points have been good and the economy is not falling off of a cliff. Last week initial jobless claims continued to decline and the week before we had positive economic releases (ISM manufacturing, ISM services and the Unemployment Report).

The largest trade deal ever was signed over the weekend and 10 countries in the Pacific that comprise 1/3 of the world's population and GDP entered the agreement. It will strengthen supply chains, reduce tariffs and institute e-commerce laws. This news sparked buying in Asia and that is spilling over to our market.

The election outcome is still being contested by President Trump and there is a Senate runoff in Georgia scheduled for January. Republicans need to win the Senate if the Trump tax cuts are going to be preserved and the market is counting on that. Politicians need to focus on the debt ceiling/budget and the stimulus bill.

Earnings season is winding down and year-over-year profits have declined 20% on average. Stock valuations are stretched, but profits could quickly return in a few months when the population is inoculated and the number of new Coronavirus cases declines. Investors don't have many attractive investment alternatives since bond yields don't keep pace with inflation. They are willing to hang onto stocks during the last stages of this soft patch knowing that earnings could improve dramatically in Q1.

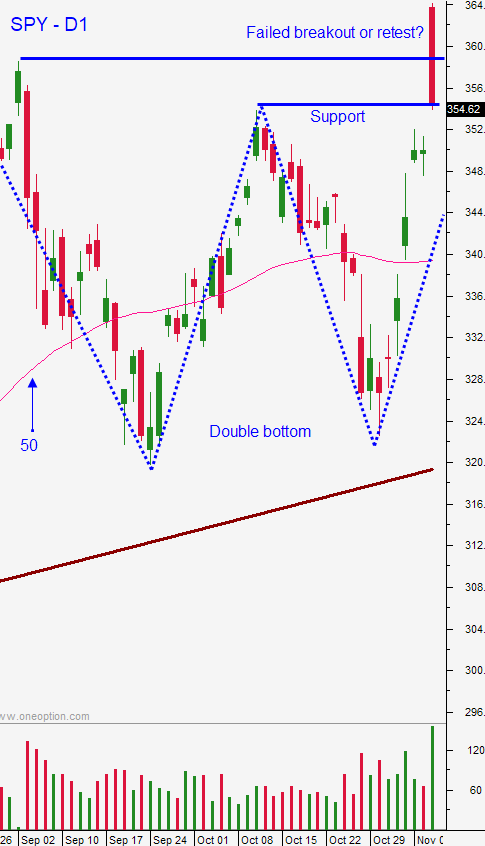

Swing traders should be selling out of the money bullish put spreads. We've seen resistance at the all-time high and the headwinds are blowing. If the market can grind back to SPY $364 and hold that level, we will consider taking a long position in SPY. I don't want to buy into a potential gap reversal like we saw last Monday so we will wait and evaluate the price action today. Selling out of the money puts is the preferred options trading strategy right now. My market bias is neutral to slightly bullish and we want to take advantage of time premium decay.

Day traders should wait to make sure that the opening gap higher holds. If the low of the day fails in the first 30 minutes of trading, we are likely to see a reversal. If we make a new high for the day after 90 minutes of trading we are likely to test the high from last Monday. Look for a rotation out of tech and into the laggards. Option Stalker searches will help us find the best stocks and the 1OP indicator will keep us on the right side of the action.

Support is at SPY $355 and resistance is at $364.

.

.

Daily Bulletin Continues...