This Is Currently the Best Options Trading Strategy To Use

Posted 9:30 AM ET - Monday the market shot 150 S&P 500 points higher on encouraging vaccine news and the selling started immediately. The market is higher than it was a week ago, but not by much. States are shutting down as the number of Coronavirus cases escalates. That will weigh on Q4 profits and there is profit-taking at this level. The headwinds are blowing.

Pfizer plans to distribute 20 million doses of its new vaccine in the US this year, but distribution will prove to be challenging since it needs to be kept at a temperature of -70°C. Moderna and AstraZeneca are in the late stages of Phase 3 clinical trials and they are mass-producing their vaccines for immediate distribution. If the results are good the FDA will fast-track these vaccines as well. Eli Lilly announced that it has a new antibody treatment that is very effective and it greatly decreases the need for hospitalization. These are all positive developments and there is light at the end of the tunnel.

Investors are willing to ride out the next few months of economic weakness in stocks because bond yields don't keep pace with inflation (negative real returns). However, they aren't aggressively buying equities when the current P/E for the S&P 500 stands at 40. That is a very rich valuation and it will take time for profits to recover. If the market gets ahead of itself like it did Monday, we can expect profit-taking.

The S&P 500 is up this morning on positive earnings news (Disney and Cisco). In general, Q3 profits have exceeded estimates, but the bar was lowered during the quarter.

The election is over, but uncertainty looms. Recounts and runoffs will take time and a Republican Senate could be in jeopardy. This is important because a Republican Senate would preserve the Trump tax cuts. Unfortunately, politicians have not moved forward with a stimulus bill. Small businesses and furloughed workers need this lifeline now. In typical fashion, DC will probably lump this together with the budget and the aid will be delayed.

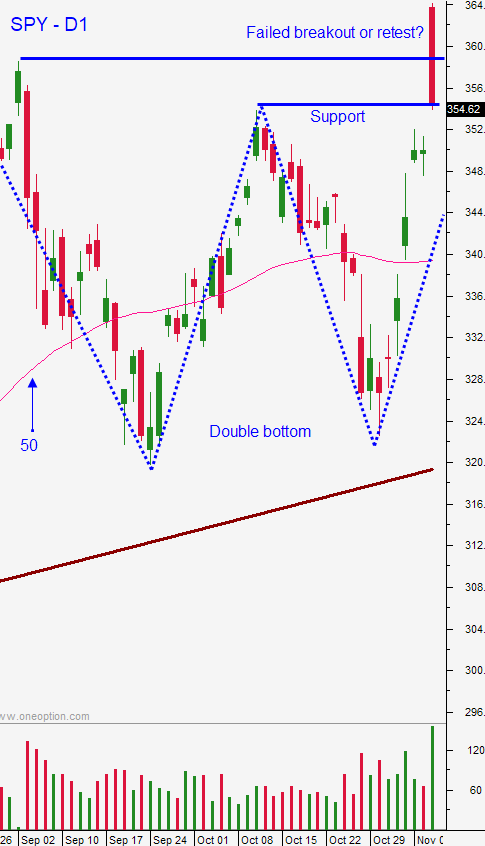

Swing traders should have sold the SPY position for a gain yesterday. I am not as bullish as I was two days ago and the price action this week tells me to temper my bullishness. If the market were going to race higher, it would have bounced Tuesday and Wednesday. The fact that it did not tells me that there is substantial selling pressure at the all-time high. My market bias is neutral and I like selling out of the money bullish put spreads. In this week's swing trading video I highlighted four new bullish put spreads and a naked put write. I will make this video public on YouTube Saturday so watch for it. We are selling the spreads on strong stocks that have relative strength, heavy volume and breakouts. The short strike price is below technical support and that increases our probability of success. When possible we are selling these spreads inside of a three week window and ideally we are able to distance ourselves by one standard deviation (or more). All of these characteristics greatly increase our odds of success and we want to take advantage of accelerated time premium decay. This is a systematic approach that I teach daily.

Day traders should stay fluid. Expect two-sided action. I still prefer to trade from the long side because the moves are much more orderly and they are much more sustained. Heavy Buying is my go to Option Stalker search right out of the gate. Then I look at PopBull. If the market dips in the first 30 minutes I start to look at Relative Strength 30. These are the stocks that are moving higher against a weak market and they will fly once the market finds its footing. After 45 minutes of trading I start looking at Bull Run as well. This is our daily routine and we don't need to change it much regardless of market conditions. The 1OP indicator governs our trading and should always have a five minute chart of the S&P 500 running in the background with this indicator. I believe that we will establish a fairly wide range in the first 90 minutes of trading and we will stay in it the rest of the day. I hope we get some decent directional movement today so that we can consider option lottery trades in the last hour.

Support is SPY $350 and $355. Resistance is $357.50 and $360.

.

.

Daily Bulletin Continues...