Market Wants To Rally But the Headwinds Are Stiff – Use This Options Strategy

Posted 9:30 AM ET - Yesterday the S&P 500 gapped higher on more good vaccine news. Moderna's vaccine is more effective than Pfizer's and it is easier to transport. Stocks were able to hold the gains through most of the day and the S&P 500 closed above an important technical level. We can expect profit-taking if the market gets ahead of itself and this will not be a runaway rally. The gains we saw from the last five minutes of trading yesterday are being stripped away this morning with the futures down 20 points before the open.

There isn't any incremental overnight news. Tesla is going to be added to the S&P 500 and that has tech stocks moving higher this morning.

Over the weekend a major Asia/Pacific trade deal was signed and it includes 1/3 of the world's population and 1/3 of the world's GDP.

The Coronavirus is spreading quickly and states are prepared for another shutdown. At least this time around we have more knowledge and the mortality rate has declined dramatically. Moderna’s new vaccine is 94.5% effective and it can be shipped at temperatures that are just above freezing. Pfizer’s drug has to be kept at -70C and that complicates distribution. Investors are looking past this rough patch and they are willing to stick with stocks knowing that the vaccines will get our economy back on track in Q1.

Politicians are not too concerned about a stimulus bill. No progress has been made since the election and it is likely to get lumped in with the budget. We are only a few weeks away from hitting the debt ceiling and this could be a giant package that gets negotiated at the last second.

Fortunately, our economy is not crashing. The numbers have been solid and that is giving politicians some breathing room. Small businesses and furloughed workers need this lifeline and hopefully it will not be delayed much longer.

Retailers will be posting earnings this week and we can expect a mixed bag. Companies with a strong online presence will do well and brick-and-mortar apparel will suffer. Stock valuations for the S&P 500 are rich at a P/E of 40.

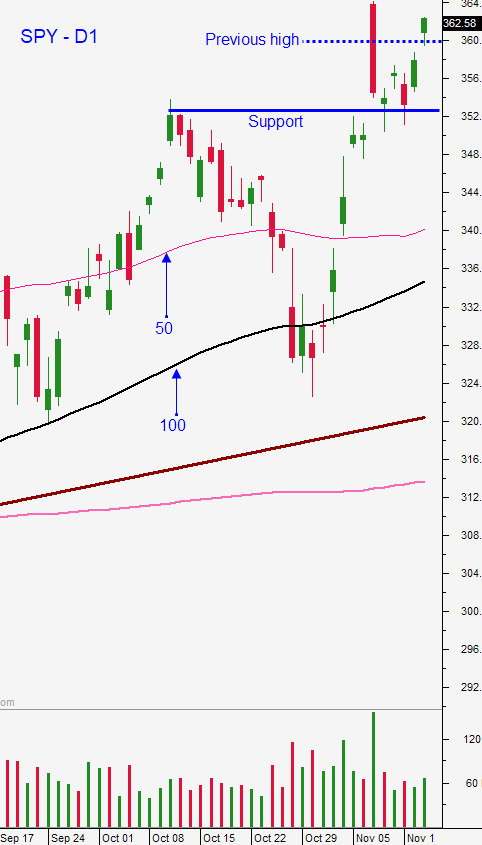

Swing traders should stick with selling out of the money bullish put spreads. Yesterday's rally did not impress me enough to buy SPY this morning. I am neutral to slightly bullish and I want to see us get through the all-time high with ease before I buy. Last week we were able to enter five new trades and I posted a new video yesterday with a nice swing trade. I want to see relative strength, heavy volume and a technical breakout through resistance. Option Stalker helps us find the stocks and I like selling bullish put spreads that expire in less than three weeks and that are below technical support. All of these factors greatly increase our probability of success and accelerated time decay is constantly working in our favor.

.

.

CLICK HERE TO WATCH THE VIDEO WITH THE BULLISH PUT SPREAD

.

.

.

Day traders should remain fluid. We've seen nice intraday movement and their opportunities on both sides of the market. We can expect similar price action today.

Support is at $358.10 and $359.60. Resistance is at $362.60 and $364.40.

.

.

Daily Bulletin Continues...