Opposing Forces Will Keep the Market In A Wide Range Through 2020 – Use This Strategy

Posted 9:00 AM ET - The S&P 500 is trapped in a wide range and opposing forces are likely to keep it there through year-end. For every positive, there is a negative.

New Coronavirus cases are escalating and states are shutting down. This will weigh on Q4 profits. Vaccines have passed Phase 3 trials and they are awaiting FDA fast-track approval. They are 95% effective and PFE and MRNA are ready to distribute them immediately. This will help the economy get back on track in Q1.

Earnings season has been in line with lowered expectations and stock valuations are rich. Bond yields don't keep pace with inflation so investors are forced to own stocks. They are willing to ride out this rough patch and they are focused on Q1.

Politicians continue to sling mud and the election results are being contested. No progress has been made on a stimulus bill, but the market is hopeful that they will get their act together this year.

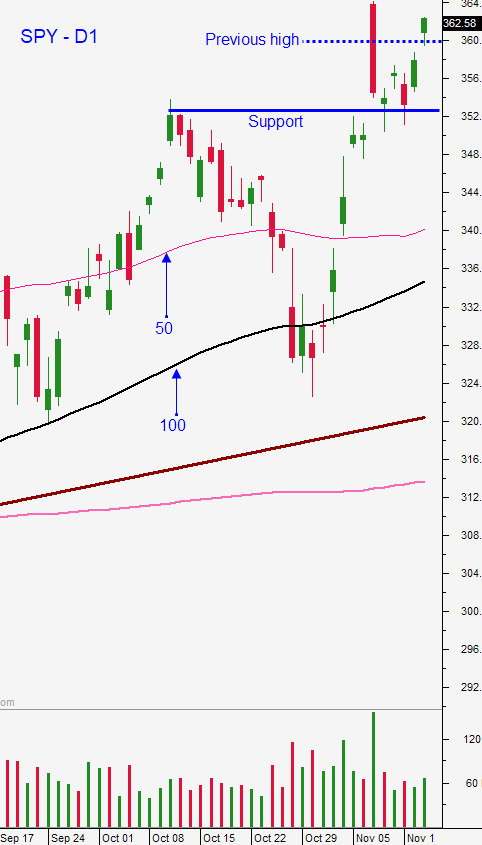

These are the forces that are in play currently. When the market drops to the low-end of the range, buyers nibble. When the market rallies to the high-end of the range, profit takers reduce risk.

Swing traders are long a half position of SPY at $360. Place an order to buy the other half at SPY $351. We will hold these positions without a stop. My market bias is neutral to slightly bullish and the best trading strategy is to sell out of the money bullish put spreads on strong stocks. This is a great way to generate income while the market is stuck in this trading range. I like to sell spreads that expire in three weeks or less and I sell them below major technical support. Stocks that are broken through technical resistance levels on heavy volume and that have relative strength are the best candidates. Option Stalker searches find these stocks.

Day traders don't have to worry too much about a market plunge. If you see strong stocks on the open that are breaking through resistance on a daily chart, consider buying them. In particular I like to see consecutive long green candles closing on their high without much overlap. These are my early plays and Heavy Buying is my favorite Option Stalker search right out of the gate. We can expect two-sided action during the day. I will be looking for option lottery trades in the last hour of trading. We buy options for pennies that have a very good chance of going in the money. The market was able to avoid a meltdown yesterday and I believe the action today should favor the upside once support is confirmed.

Support is at SPY $354 and resistance is at $358.30 and $362.

.

.

Daily Bulletin Continues...