Use This Options Trading Strategy While the Market Is Trapped In A Wide Range

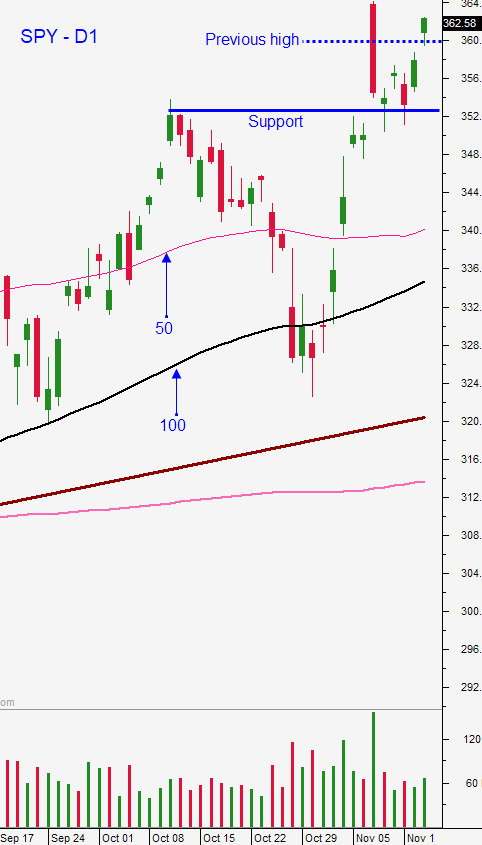

Posted 9:30 AM ET - The S&P 500 is trapped in a 150 point wide trading range. The promise of an economic recovery in Q1 sparked by immunization is keeping buyers engaged while lofty valuations and a rapid rise in new Coronavirus cases is prompting profit-taking. I believe that the market will stay within this range the remainder of the year and my bias is neutral to slightly bullish.

AstraZeneca released its Phase 3 clinical trial results and they were not as good as Pfizer or Moderna (70% effective vs 95%). AstraZeneca’s vaccine is much easier to distribute since it does not have to be refrigerated.

The number of new cases is escalating and states are shutting down. Europe has been in shutdown mode for over a month and that is impacting economic activity. This morning we learned that Europe's flash PMI fell to 45.1(contraction). In the US we saw a rise in initial jobless claims last week. The economy is not falling off of a cliff, but we can expect soft holiday spending this year as many workers are furloughed. Politicians are not sensing the urgency for a stimulus bill and negotiations are on hold until after Thanksgiving.

The budget/debt ceiling will need to be addressed when politicians return if a government shutdown is to be avoided in December. In typical DC fashion, they will lump this together with a stimulus bill and it will take forever to pass.

The election results are being contested and there is an intense interest in the Georgia Senate runoffs in January. These two seats will determine which party has control of the Senate. If Democrats win, the market is likely to decline because the Trump tax cuts could be repealed.

Swing traders are long a 1/2 position of SPY at $360. Place an order to buy half position at $351. We will hold the current position without a stop. The best swing trading strategy right now is to sell out of the money bullish put spreads. Last night I posted a video with two stocks that I like. Heavy volume, horizontal breakouts and relative strength are important characteristics when selecting the best stock. Sell the bullish put spreads below technical support and focus on options that expire in less than three weeks.

.

.

CLICK HERE TO WATCH THE VIDEO - 2 NEW OPTIONS TRADES

.

.

.

Day traders should go with the flow. We've seen two-sided price action during the day and there are opportunities on both sides. The trading volume will drop significantly this week and you should consider trading smaller size. I still prefer to trade on the long side. The price movement is more orderly on longs and the moves are sustained. Opening gaps higher are my least favorite set up. Relative strength is harder to identify and we have to be passive because we don't know if the gains are immediately going to reverse. I will be waiting for a dip and then I will be looking for a good entry point for stocks that are on Heavy Buying, Relative Strength 30, and Bull Run Option Stalker searches.

Support is at $354.60 and resistance is at $358.40.

.

.

Daily Bulletin Continues...