The Market Will Test the Downside – Wait For Support – Sell Some Puts

Posted 8:30 AM ET - There wasn't any incremental overnight news so I'm going to keep my comments brief. New vaccines are growing as quickly as the virus and both headlines are negating each other. Economic conditions are solid, but this wave of the virus will hurt consumption as states shut down. A stimulus bill is likely, but politicians are not in a hurry to negotiate a deal. Stock valuations are rich, but they are attractive on a relative basis with bond yields producing negative real returns. For every positive, there is a negative. Buyers and sellers are paired off and the price action is choppy.

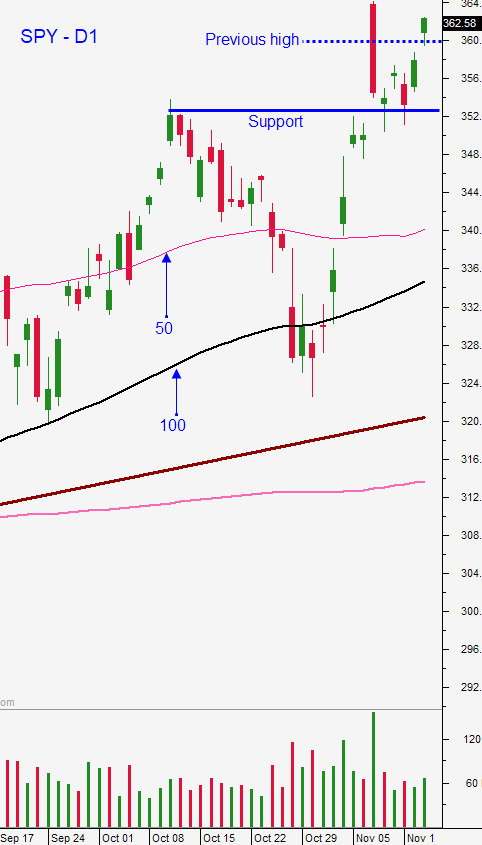

Yesterday the S&P 500 drop was a reminder that the year-end rally is very fragile. Once support at the prior day’s low was breached, sell programs kicked in and the selling pressure accelerated. The market will test the downside early today and once support is established we are likely to stabilize. I still expect the choppy grind higher fueled by seasonal strength to continue.

Yesterday we bought a half position of SPY at $360. We will hold without a stop for now. Swing traders should sell out of the money bullish put spreads on stocks with relative strength. They should also look for technical breakouts through resistance on heavy volume. Stocks with these characteristics are ideal candidates and we are selling these options spreads inside of a three week window below technical support. Accelerated time decay is working in our favor and we can continually evaluate market conditions when they expire. Swing traders can place an order to buy a 1/2 position of SPY at $360. If we are not filled today, cancel the order. I want to passively be long the market and we will add the other half if conditions warrant. Last night I published a new weekly swing trading video and it has 6 new trades we will try to enter today.

The market will test the downside today before we get any decent rally. Our day trading routine doesn't change much. It is fluid and we are able to adjust to changing conditions. I have been waiting for intraday dips and I have been buying stocks with relative strength when the 1OP indicator troughs (SPY 5 minute chart). Down opens are my favorite set up and yesterday we had some very "beefy" gains on stocks we bought. When the 1OP indicator spikes, it's time to take profits on longs. Opening gaps higher are my least favorite set up and that's what will have this morning. It is more difficult to identify relative strength under these conditions and we have to patiently wait to make sure that the bid is strong. Oftentimes we miss the initial move higher, but we don't run the risk of a gap reversal pulling the rug out from under us. Be patient on the open and use Heavy Buying, Relative Strength 30, Bull Run and PopBull as you go to searches and Options Stalker.

Support is at SPY $350 and $355. Resistance is at $358.30 and $361.50.

Daily Bulletin Continues...