Stock Option Trading Strategy – Long calls on heavy equipment and oil stocks.

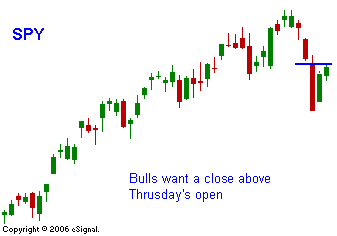

After a big sell off, the bulls should be happy with a nice boring day. The market had decent selling pressure last week and on Friday it staged a huge snap back rally. Today, M&A news and stable overseas markets are keeping a "bid" to this market. Interest rates are creeping higher and the market is trying to digest changing conditions. If the inflation data this week shows that consumer and producer prices are only moderately rising and are within The Fed’s acceptable range, the market will rally. Expiration related by programs could materialize if the market nears the old highs. Today will be a relatively quiet day and I believe prices could move slightly higher. I still like energy and heavy equipment stocks and I am long calls in those areas.

Daily Bulletin Continues...