Stock Option Trading Strategy – Wait for a decline and support, than buy the dip.

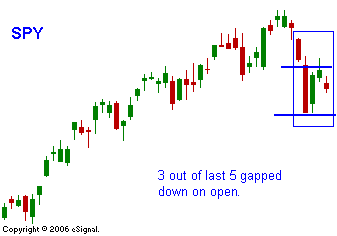

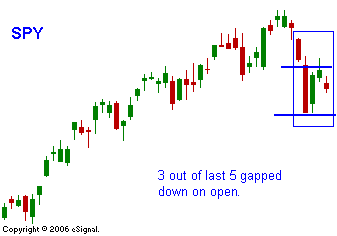

The market is trying to adjust to higher interest rates and this transition will take time. From a technical standpoint, the bulls wanted to see the market close yesterday above Thursday's open (last weeks big down day). It looked like that might happen early in the day. The market opened strong and it added to Friday's bounce. However, by the end of the day prices drifted lower until they were almost unchanged. This indicated selling pressure. This morning the market pulled back on news that China's inflation is rising faster than expected. In the chart you can see that three of the last five days have gapped lower on the open. This price action is concerning when it comes near an all-time high. Resistance is building and the market may need a bona fide catalyst to push it to new all-time highs. In prior weeks, the market has been able to grind higher simply because that was the path of least resistance. The inflation numbers this week will be pivotal and they will be able to push the market in either direction. Personally, I am hoping the market will retrace and test the SPY 146 level. That was the breakout level and it represents a 5% decline from the high. I will give the edge this week to the bulls. They have been able to destroy the bears this year and during expiration week we have seen a bullish bias. The long-term trend is still higher and it is premature to call a top. Take your short term lead from last Thursday. If the market closes below that close, we are headed lower. If the market closes above that open, we are headed back up to test all-time highs. I still like energy and heavy equipment. Conduct research and line up stocks that look strong during this pullback.

Daily Bulletin Continues...