Stock Option Trading Strategy – Bullish put spreads on stocks that held up well in February.

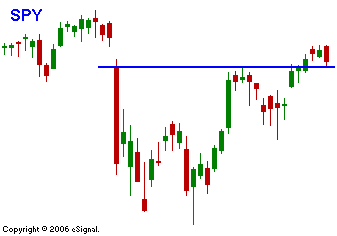

Yesterday AA kicked off the earnings season with positive news. Given the 8-day grind higher, you would have expected a market rally. Traders stripped away the pre-open gains and tested the downside right after the bell. Once the oil inventory numbers were released, oil moved higher and the market continued the slide. The A/D is a negative 1:2 and this seems like a half-hearted attempt at a sell-off. The bulls would like to see the support line in the chart hold. It represents the opening the day of the big February decline. I feel that the market has already been able to shrug off oil prices that are much higher than this. It feels like a bit of profit taking and there is not a bona fide catalyst to drive prices lower today. The momentum is up and if the bears can’t make a new low by noon CST, the bulls will take charge and rally the market back to unchanged. There is support at SPY 141 and resistance at SPY 146. Anything in between is noise. My option trading strategy continues to favor bullish put spreads.

Daily Bulletin Continues...